by Farley Webmaster | Sep 14, 2017

When you’re buying or selling a home, it’s crucial to work with a qualified real estate agent. Not just a professional, but an amazing agent and a market expert. So how do you ensure you’re hiring an amazing real estate agent?

There are currently more than two million real estate professionals in North America.1,2 With so many options to choose from, how does a prospective home buyer or seller choose the right agent or broker? According to the National Association of Realtors®, trust and reputation are the top deciding factors consumers use when hiring an agent.3

But how do you measure trust and reputation … and what criteria can be used to help you make your decision?

In this guide, we’ve outlined the top attributes that amazing agents possess, as well as the questions you can ask to make sure you’re working with the right market expert to achieve your real estate goals.

5 ATTRIBUTES OF AN AMAZING AGENT

Not all real estate professionals are the same. Following are five key attributes of amazing agents to help you understand what makes top agents and market experts stand apart from the competition:

1. A Pricing Specialist: For buyers, amazing agents have a strong understanding of market trends to help you identify and secure a deal to ensure you get the home you want, within your desired budget. For sellers, market experts have experience pricing homes optimally for the market, helping you sell for your desired price, and avoid costs like additional mortgage and utility payments.

Takeaway: Whether buying or selling a home, pricing can be tricky. Market experts can help navigate best-possible pricing strategies, and also secure the home you want within your budget.

2. An Effective Time Manager: The average agent may not be utilizing the latest tools and technology to make the transaction easier and more cost effective for you. Market experts have tools and strategies at their disposal to minimize the amount of time you spend on the process. For sellers, they can also ensure you only deal with qualified buyers, not “window shoppers” who waste your time. For buyers, a market expert knows how to prioritize your needs and wants to find you the ideal home within your budget, without wasting your time on houses that aren’t a fit or are likely turn up major issues in an inspection.

Takeaway: Even a well-intentioned agent may not have the skills, tools or technology to make the experience easy for you. There are lots of hidden activities that may take up unexpected time, and a market expert will save you time and energy.

3. A Market Insider: While most agents can pull market stats about a neighborhood, community or city, they may not understand important trends or developments that would affect your transaction. Market experts live and breathe local real estate and know the trigger points for buying and selling in your market. We also stay current on effective marketing and negotiation practices, resulting in our track record of success.

Takeaway: An experienced real estate agent is often the best source of information about a city, neighborhood, or even street … we’re literally conducting market research every day.

4. A Strong Negotiator: Amazing agents truly set themselves apart in their ability to negotiate. Real estate negotiations take skill, experience and a knowledge of how to fight for your client’s best interests. While any agent can enter negotiations to buy or sell a home, experienced Realtors understand what to do before entering negotiations (establishing the upper hand), as well as during the process (when to offer or accept concessions) in order to set up the best outcome.

Takeaway: Working with a market expert will help ensure you get the best deal on your terms, not just the fastest deal.

5. An Effective Closer: Closing a deal fast is often a good thing. However, top real estate professionals know how to not only achieve your real estate goals quickly, but in the right way to avoid pitfalls. Just like negotiations, the paperwork and process of closing a real estate transaction are complicated. Market experts have a strong understanding of the contracts, timelines, clauses and contingencies within the closing process.

Takeaway: Real estate transactions often involve a significant investment, so even a small mistake can mean serious trouble. With that in mind, it’s best to work with a true market expert.

5 QUESTIONS TO ASK YOUR REAL ESTATE AGENT

The first step would be to “shop around.” Many people work with the first agent they come across without a firm understanding of their level of experience. It’s always a good idea to interview a number of agents before selecting one. If you’ve gotten referrals from people you trust, then you may only need to interview 2-3 agents.

However, it can be tough to know what to ask in the interview process. Here are some questions that can help you qualify the best agent to help you achieve your real estate goals:

1. Can you send me some information about yourself? Look for professionalism and consistency. What are their accomplishments? See how they approach their work. If they’re a newer agent, ask about their team’s dynamic and accomplishments.

2. How long have you been in real estate? While longevity is important, even more telling are the number of transactions they have closed or been involved in. So feel free to also ask: “How many homes have you sold in this area?”

3. What will you do to keep me informed? Will the agent be able to meet your expectations? Determine how much communication you want, and then find an agent who will give you the attention and time you deserve.

4. Can you provide me with further resources I may need? From market reports and pricing trends to school performance and crime statistics, top agents should have resources at their disposal … or know where to find them.

5. Seller only: Can you share with me your plan to market my property? Many agents will simply put your home in the MLS and wait for it to sell. An amazing agent should have a detailed plan of how to get your home exposure on social media, to their local networks, and more.

GET STARTED

Now that you’re armed with the 5 Attributes of Amazing Agents and the Top Questions to ensure you work with the best possible real estate agent, you’re ready to start interviewing agents.

We’d love an opportunity to win your business. Schedule a free consultation with us to find out how true market experts can help you achieve your real estate goals!

Sources:

1. National Association of REALTORS –

https://www.nar.realtor/field-guides/field-guide-to-quick-real-estate-statistics

2. Financial Post –

http://business.financialpost.com/personal-finance/mortgages-real-estate/canada-housing-bubble-agents/wcm/b49d4e3a-bd8d-4d1c-9566-bd3d80c8e23a

3. National Association of REALTORS –

https://www.nar.realtor/reports/highlights-from-the-profile-of-home-buyers-and-sellers

by Farley Webmaster | Aug 30, 2017

More than 77 percent of people own a smartphone.1 The average person checks their smartphone 46 times a day, with people under the age of 24 checking it an average of 74 times a day.1 We check it while we’re waiting in line and during our leisure time, whether we’re scrolling through social media, reading emails or getting up-to-date on the latest news.

Smartphones are not only a useful tool for communication. With the following apps, you can get organized (whether you plan to buy or sell), save money, learn about the homes in your neighborhood and get inspired for your next renovation project. If you’re like 81 percent of people, you have your smartphone with you during most of your waking hours; let it help you stay organized and make your life easier.3

Apps For Homeowners: Get Renovation Inspiration

These apps not only offer ideas for your next remodel or home décor project, some of them even give you a preview of what your home may look like once it’s finished.

1.) Houzz (Free)

The Houzz app is the number one app for home design and it’s no wonder; the app gives you access to all the inspiration, blogs and design ideas from the Houzz site on your phone or tablet. The app features View in My Room 3D, which allows you to view products in your home before you buy. Just take a photo of the space and a 3D version of the product will appear. Browse products, save photos of designs you’d like to view later and connect with local professionals in your area. Whether you’re gathering ideas for your next renovation and décor project or you’re just browsing, the Houzz app will satisfy all your design needs. (Android, iOS)

2.) iHandy Carpenter ($1.99)

Make sure the photos, shelves, mirrors and other artwork you hang are even and aligned with this helpful app. It’s an all-in-one tool kit that features a plumb bob, surface level, bubble level bar, ruler and protractor. No need to purchase these tools separately; just hold your smartphone up to the wall and the app will take care of the rest. (iOS, Android)

3.) Color911 ($3.99)

If you’re thinking of changing the color scheme of your home or want to find the right shades for lamp shades, rugs or throw pillows to match your vintage sofa, the Color911 app provides pre-selected color palettes to match any color scheme. Take a photo of the room or the furniture and the app will create a custom palette full of complementary colors. Write notes about your palette and organize it all into folders to share with family, friends or your design professional. (iOS)

Bonus Apps for Homeowners:

AroundMe (Free)

Hungry and looking for a local hotspot? Meeting friends at a coffee shop nearby? Or just need to find the closest ATM? AroundMe allows you to search for the nearest restaurants, banks, gas stations, book a hotel or find a movie schedule close to where you live. Open the app and start learning more about your neighborhood. (iOS, Android, Windows)

BrightNest (Free)

From keeping things clean to making them colorful, Brightnest, developed by Angie’s List, is loaded with suggestions on how to make your home a better place to live. With categories of customized tips (money-saving, cleaning, eco-friendly, healthy, cooking, and creative) there are plenty of great ways to pull inspiration from the app. BrightNest will help you tackle important home tasks with easy-to-follow instructions, a personal schedule and helpful reminders. (iOS, Android, Web)

Apps For Sellers: List & Sell Your Home Quickly

Are you a homeowner who is thinking of selling? If you’re preparing to sell, you know there are a lot of tasks to complete before putting your home on the market. These apps help you manage your to-dos so you can list and sell your home more efficiently with fewer distractions.

4.) Homesnap (Free)

Using the Homesnap app, you can snap a photo of any home, nationwide, to learn more about it. When you’re ready to sell, snap a few of the homes in your neighborhood to find out their valuation. This app isn’t perfect, which is why you should always consult with a local real estate agent. However, it can give you a general idea of the value of your home compared to others in the neighborhood. (iOS and Android devices)

5.) Docusign (Free)

Use the DocuSign app to complete approvals and agreements in hours—not days—from anywhere and on any device. Quickly and securely access and sign any documents. The benefit to using the app (over your desktop computer) is you will receive push notifications when a document is waiting for your signature and you can view and organize all your docs on-the-go. Using the easily downloadable app, receive and sign documents for free. You can receive and sign documents for free, but will need a paid account to send documents; pricing starts at $10 a month. (iOS, Android, Windows, Web).

6.) Wunderlist (Free)

Designed for use on the Web and mobile devices, Wunderlist is a well-designed to-do list and task management program that makes it easy to create a list and add tasks, due dates and reminders. Organize your ideas or focus into separate lists or create tasks within one list. You can also email them with whomever you collaborate, such as a spouse or your real estate agent. (Android, iOS, Windows Phone, Web)

Bonus App for Sellers:

Real Estate Dictionary (Free)

Not sure what all those industry specific terms mean? Search thousands of words and phrases from real estate, mortgage, and financial dictionaries for clear, in-depth definitions. This is a handy app for anyone who’s buying or selling and wants to learn more about the process. (iOS, Android)

Apps For Renters: Get Ready to Buy

Not ready to buy a home just yet? These apps will help you get into the perfect rental while you save money, build a budget and get on track for homeownership.

7.) Mint (Free)

Do you know where your money goes each month? Manage your bills, budget and credit score all in one place. Mint is a free app that helps you view your complete financial picture and track your spending. We recommend this app to anyone, but it’s especially useful for renters who need to crack down on their spending in order to save for a down payment. Use Mint to look for areas you can cut spending in order to save a little extra each month. (iOS, Android)

8.) Acorns ($1 a month to start)

Acorns is modernizing the practice of saving loose change with their automated savings tool. The app rounds up your purchases on linked credit or debit cards, then sweeps the change into a computer-managed investment portfolio. Acorns is free for four years for college students and everyone else pays $1 a month until their account balance hits $5,000, then 0.25% of their account balance per year. This is a useful tool for those who have a hard time saving. (iOS, Android)

9.) Neighborhoods & Apartments

Built for the on-the-go apartment hunter, this app from Walk Score takes the hassle out of finding your next home or apartment and helps you live near the people and places you love. They collect listings from top rental listing sites and we like them because they share how walkable each address is, determined by access to public transit, things to do, bike trails, shorter commutes, etc. (iOS, Android)

Bonus Apps for Renters:

Wally (Free)

Wally is a personal finance app that helps you compare your income to expenses, so you can understand where your money goes each month, and set and achieve goals. Wally lets you keep track of the details as you spend money: where, when, what, why, & how much. We love how simple it is to set a personalized savings target and scan receipts. (iOS, Android)

Credit Karma (Free)

If you’re preparing to buy, boosting your credit score is likely a goal you’ve set. Credit Karma is a free app that allows you to safely monitor your score and receive updates on ways you can improve it over time. They provide financial calculators and educational articles to help you better understand what credit is all about. Check as often as you want, and it doesn’t hurt your score. (iOS, Android, Web)

Apps for Buyers: Find the Perfect Home

When you’re ready to buy, there are several apps that can help you stay on top of the process. Whether you’re browsing online at different neighborhoods and homes and can’t seem to remember where all your saved data and information went or you want to save an important task or a neighborhood or listing clipped from the Web, these apps help you keep it all straight.

10.) Dwellr (Free)

Dwellr is run by the U.S Census Bureau and provides demographic information about the neighborhoods you are considering moving to. You get a variety of education/school, real estate, transportation, and population statistics to give you an idea of what it would be like living there. If you want to get the feel of a potential neighborhood, then Dwellr may just be the app to help you find the best home. (iOS, Android)

11.) Evernote (Free for the Basic version, $34.99 per year for Plus and $69.99 per year for Premium)

Collect ideas, notes and images in one place to access later on your computer, tablet or smartphone. Categorize your notes so you can find them quickly and easily and share them with others in a group notebook. Add the Web Clipper feature to your browser and clip and save articles, blogs and images from the Web. Whether you’re collecting research on a business idea or you’re looking for inspiration for a home renovation, Evernote can help you keep it all together. (Web, iOS, Android)

12.) Mortgage Calculator (Free)

There are a lot of free mortgage calculators available for download that will help you quickly determine what your monthly payment will be while you’re house hunting. We recommend picking your favorite and using it to help you shop in your price range. These numbers should be used as a guide, work with your agent and mortgage professional to learn exactly what type of loan you’ll qualify for. (Web, iOS, Android)

Bonus App for Buyers:

Google Maps (Free)

Google Maps is a must-have for anyone who’s house hunting. When you’re ready to visit a property or check out a neighborhood, you can use Google Maps to give you turn by turn directions to the house. You can use their satellite view to get a good idea how far important things like schools, parks, shopping, bus stops, and restaurants are to a home you are interested in and check out the other houses on the street. (Web, Android, iOS,)

Ready to move beyond the app?

If you’re thinking of buying or selling your home, or know someone who is, keep us in mind because we’re happy to help!

Source: 1. Pew Research Center, January 12, 2017 http://www.pewresearch.org/fact-tank/2017/01/12/evolution-of-technology/

- Deloitte, 2016 global mobile consumer survey: US edition https://www2.deloitte.com/us/en/pages/technology-media-and-telecommunications/articles/global-mobile-consumer-survey-us-edition.html

- Gallup, July 9, 2015 http://www.gallup.com/poll/184046/smartphone-owners-check-phone-least-hourly.aspx

by Farley Webmaster | Jul 19, 2017

Understanding a home’s true market value is about more than pictures, software assessments and price-per-square-foot. Whether you’re a current homeowner thinking of selling or are house-hunting, it’s crucial you understand what factors affect home valuation. By partnering with a local market expert, sellers will avoid pricing their house out of the market (the kiss of death in real estate) and buyers will ensure they get a good deal on their next home.

So, how do you accurately calculate a home’s value? After all, the value a home is assigned by its town or county and the one it’s given when it’s listed are often dramatically different from one another. Which one is accurate and what does it all mean? Read on to learn more.

Assessed Value vs Market Value: What’s the difference?

When it comes to home value, you’ll often hear two terms, assessed value and market value.

A home’s assessed value is often the lower number of the two, and is the value given by your municipality or county. Investopedia defines assessed value as “the dollar value assigned to a property to measure applicable taxes.”1 Although property tax laws vary, assessors commonly arrive at this number by taking into account the following:

- What comparable/similar homes are selling for in your area.

- The value of recent improvements.

- Income from renting out a room or space on the property.

- How much it would cost to rebuild on the property.

A home’s market value, or Fair Market Value, is the price a buyer is willing to pay or a seller is willing to accept for a property. A skilled real estate professional will arrive at the value using a variety of metrics, including:

- External characteristics, such as lot size, home style, the condition of the home and curb appeal.

- Internal characteristics, such as the number of rooms and their size, the type and condition of the heating or HVAC system, the quality and condition of construction, the flow of the home, etc.

- The sales price of comparable homes that have sold in your area.

- Supply and demand; that is, how many buyers and sellers are in the area.

- Location; that is, the quality and desirability of your neighborhood and other community amenities.

Why are these values often so different? An assessor usually estimates your property’s market value during a reassessment or if you make a physical change or improvement to it.2 As a result, a property may not be reassessed for many years. While your home’s market value may fluctuate with the market, your home’s assessed value is more likely to remain steady.3

What Determines a Home’s Value?

You’ve likely heard the motto of real estate: “Location, location, location.” This means a home’s value relies on its location. While the home and structures on the property will likely depreciate over time, the land beneath it tends to appreciate. Why? Land is in limited supply and a growing population puts increased demand on the housing supply. As a result, values increase.4

Other factors that affect your home’s value include the function and appearance of the property, how well the home and other structures are maintained and whether the home is a lifestyle property, such as a ranch style with mountain views or beach bungalow.

Ultimately, the best indication of a home’s value is the overall supply and demand of the market. This is why we recommend you partner with a real estate professional who takes all of these factors—the assessed value, local market conditions, home features and has physically walked through and experienced your home— into consideration to determine the most accurate market value.

How to determine if a property is comparable to yours.

Both assessed value and market value are partially determined by the sales price of similar, or comparable, homes in the area. To determine if a home is comparable to yours, look for the following characteristics:

- Lot size

- Square footage

- Home style or similar architecture

- Age

- Location

While you may not find a home with the same exact characteristics as yours, you’ll likely find a few that are close. To account for any disparity, adjust the sales prices of the comparable properties. Look at the differences between your property and the one in question and determine if the differences increased or decreased the sales price and by how much. For example, if your home has two bathrooms and a similar home only has three, estimate how much that extra bathroom increased the sale price of the similar home. The adjusted sale price is the estimation of what the property would sell for if the properties were exactly the same.2

Where can you find comparable sales?

Fortunately, you can find comparable home sales in a variety of places.2

- Your local assessor’s office is able to provide a list of recent sales you can browse and compare or a sales history of a particular house, home style or neighborhood.

- Your municipality. Many cities keep local sales information in their offices or post it online.

- Online databases, such as a real estate database

- Your local newspapers may offer some real estate information in the form of quarterly sales reports in the business or real estate sections of the newspaper.

- Our office. We regularly do Comparable Market Analysis of homes in our local area.

How to calculate your home’s value.

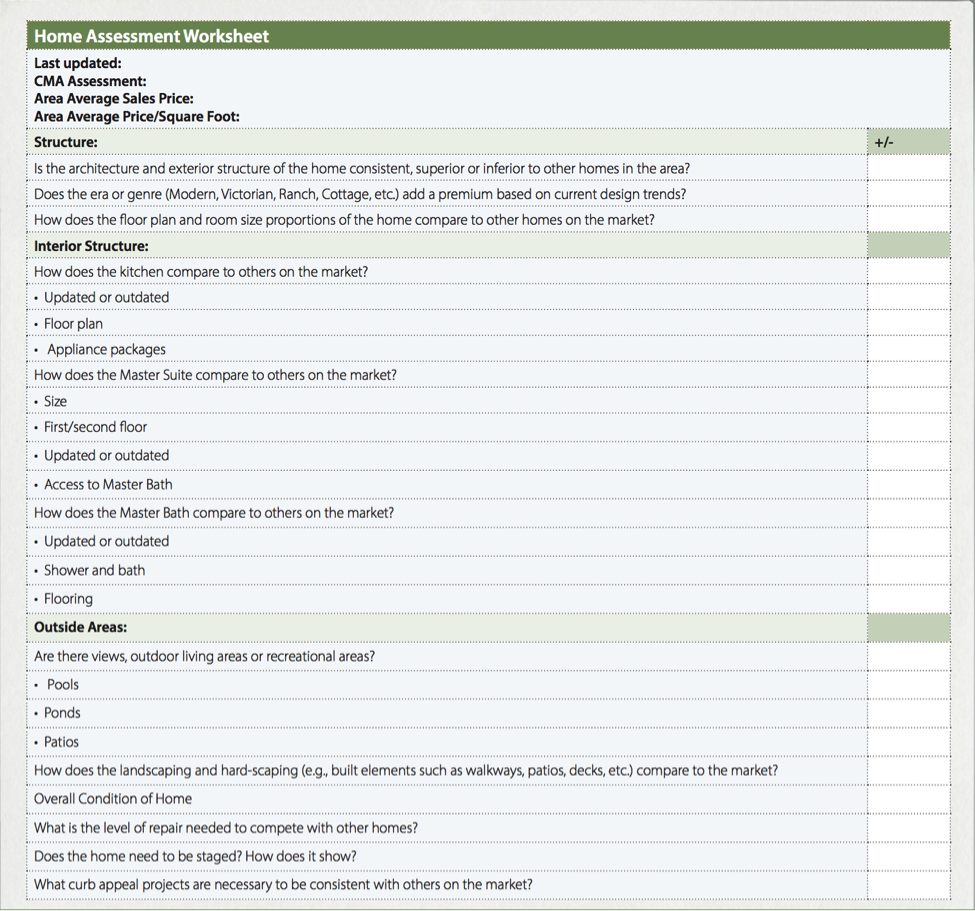

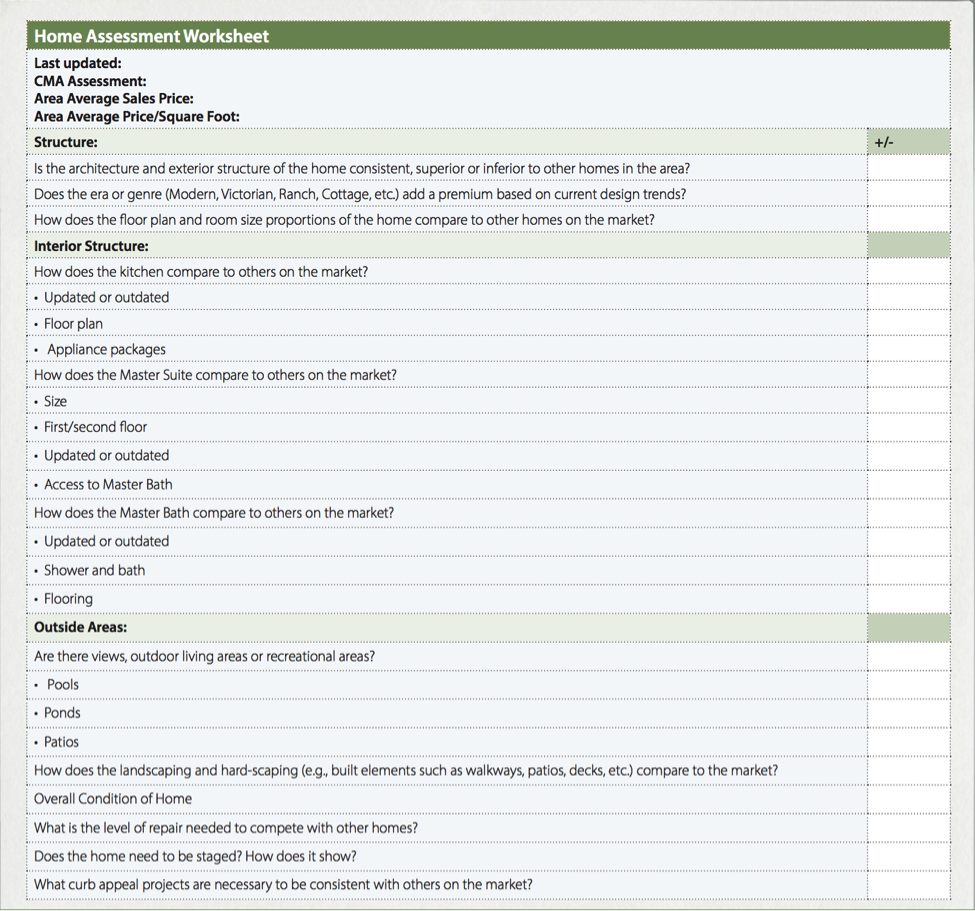

By answering a few questions about your home, property and the local market, you can begin to estimate your property’s value. We’ve also included a worksheet for you below…

Home Value Questions:

When was your home last assessed?

What was its CMA assessment value?

What is your area’s average sales price?

What is your area’s average price/square foot?

Structure:

- Is the architecture and exterior structure of the home consistent, superior or inferior to other homes in the area?

- Does the era or genre (Modern, Victorian, Ranch, Cottage, etc.) add a premium based on current design trends?

- How does the floor plan and room size proportions of the home compare to other homes on the market?

Interior Structure:

- How does the kitchen compare to others on the market?

- Updated or outdated

- Floor plan

- Appliance packages

- How does the Master Suite compare to others on the market?

- Size

- First/second floor

- Updated or outdated

- Access to Master Bath

- How does the Master Bath compare to others on the market?

- Updated or outdated

- Shower and bath

- Flooring

Outside Areas:

- Are there views, outdoor living areas or recreational areas?

- How does the landscaping and hard-scaping compare to the market? (e.g., built elements such as walkways, patios, decks, etc.)

Overall Condition of Home

- What is the level of repair needed to compete with other homes?

- Does the home need to be staged? How does it show?

- What curb appeal projects are necessary to be consistent with others on the market?

Home Assessment Worksheet

If you want to accurately assess a home’s value, it’s crucial to know about the market activity of our local area. We can help! Give us a call at 303-475-6269 to get the scoop on the local market.

Sources:

- Investopedia http://www.investopedia.com/terms/a/assessedvalue.asp

- New York State Department of Taxation and Finance https://www.tax.ny.gov/pubs_and_bulls/orpts/mv_estimates.htm

- Realtor.com http://www.realtor.com/advice/sell/assessed-value-vs-market-value-difference/

- Investopedia, http://www.investopedia.com/articles/mortgages-real-estate/08/housing-appreciation.asp?lgl=myfinance-layout

SaveSave

SaveSave

by Farley Webmaster | Dec 2, 2016

The hustle and bustle of the holiday season is officially underway, join in the festivities by attending some exciting winter events!

Want to see something on our monthly calendar? Email us at john@john-farley.com.

| Date |

Event |

Time |

Location

|

| Dec 2 |

Of Earth: Boulder’s Potters Guild

(Dec 2 – Jan 8 |

Times Vary, see website |

Dairy Arts Center

2590 Walnut Street

(26th & Walnut)

Boulder, Colorado |

| Dec 3 |

Saint Nick on the Bricks

(Free; Saturdays Nov 26 – Dec 24) |

11 AM – 2 PM |

Downtown Boulder Visitor Information Center

1301 Pearl Street |

| Dec 4 |

Homes for the Holidays Tour Celebrates Magnificent Mapleton Hill |

11 AM – 4 PM |

Mapleton Hill |

| Dec 5 |

Thoroughly Modern Millie

(Nov 19 – Feb 15) |

Times Vary, see website |

Boulder Dinner Theatre

5501 Arapahoe Ave.

Boulder, CO 80303 |

| Dec 6 |

Brewhouse Yoga

($15 per class; free beer in the tap room) |

Every Tuesday at 6pm |

Sanitas Brewing Co.

3550 Frontier Ave, Boulder, CO 80301 |

| Dec 7 |

Warren Miller Extreme Sports Movies Wednesdays

(February 24 – December 28, 2016; FREE) |

8:30 PM |

|

| Dec 8 |

Ukelele Orchestra of Great Britain

($20+) |

7:30 PM |

MACKY AUDITORIUM 1595 Pleasant Street

Boulder, CO 80309 |

| Dec 9 |

VAIL SNOW DAZE

(Dec 9 – 11) |

Various times for festivities, see website |

Vail Village |

| Dec 10 |

Children’s Art Workshop: Playing with Clay

(Ages 6 – 12 / $10 each) |

10:30 AM – 12 PM |

Dairy Arts Center

2590 Walnut Street

(26th & Walnut)

Boulder, Colorado |

| Dec 11 |

TIG NOTARO

with NANCY NORTON

($35) |

8 PM |

|

| Dec 12 |

Open Mic Night |

6 PM |

License #1

2115 13th St |

| Dec 13 |

SiriusXM Presents The Brian Setzer Orchestra – Christmas Rocks! Tour |

8 PM |

|

| Dec 14 |

Colorado Avalanche vs Philadelphia Flyers |

8 PM |

Pepsi Center

1000 Chopper Circle, Denver, CO 80204 |

| Dec 15 |

Denver Nuggets vs Portland Trail Blazers |

7 PM |

Pepsi Center

1000 Chopper Circle, Denver, CO 80204 |

| Dec 16 |

Nathaniel Rateliff & the Nightsweats

($36+; Dec 16 & 17) |

9 PM |

Ogden Theatre

935 East Colfax Avenue

Denver, Colorado 80218 |

| Dec 17 |

Adult/Teen Art Workshop: Set the Mood: Using Toned Paper & Subtractive Techniques in Drawing

($50 teens/$65 adults) |

10 AM – 1 PM |

|

| Dec 18 |

Rudolph The Red-Nosed Reindeer: The Musical

($20+; Dec 16 -18) |

2 PM |

Buell Theater

1400 Curtis St.

Denver, CO 80202 |

| Dec 19 |

Denver Nuggets vs Dallas Mavericks |

7 PM |

Pepsi Center

1000 Chopper Circle, Denver, CO 80204 |

| Dec 20 |

12 DAYS OF ASPEN

(Dec 20 – 31) |

Various activities, see website |

Aspen, CO |

| Dec 21 |

Finding Neverland

($30+; Dec 20 – Jan 1) |

Times Vary |

Buell Theater

1400 Curtis St.

Denver, CO 80202 |

| Dec 22 |

Colorado Avalanche vs. Toronto Maple Leafs |

7 PM |

Pepsi Center

1000 Chopper Circle, Denver, CO 80204

|

| Dec 23 |

The Long Run, Colorado’s Tribute to the Eagles – A Special Holiday Show! |

7 PM |

|

| Dec 24 |

Scrooge: Bah Humbug!

(Dec 2 – 28) |

1 PM |

Jesters Dinner Theatre

|

| Dec 25 |

MERRY CHRISTMAS! |

|

Where to Dine in Boulder |

| Dec 26 |

Bluegrass Jam |

7:30 – 9:30 PM |

820 Main St.

Louisville, CO

|

| Dec 27 |

Open Mic Night |

6 – 8 PM |

3201 Walnut St ste A

Boulder, CO

|

| Dec 28 |

Otis Taylor Band |

8 PM |

Dazzle Jazz

930 Lincoln Street

Denver, CO, 80203 |

| Dec 29 |

THE STRING CHEESE INCIDENT

Big Gigantic Incident

(Dec 29-31; $49.95+) |

8 PM |

1stBank Centre

11450 Broomfield Lane

Broomfield, CO 80021 |

| Dec 30 |

YONDER MOUNTAIN STRING BAND

with THE RAILSPLITTERS

(Dec 30 & 31; $35 or $90 for two day pass) |

8 PM |

|

| |

The Beach Boys: 50 Years of Good Vibrations |

7:30 PM |

Paramount Theatre

1621 Glenarm Pl,

Denver, CO 80202 |

| Dec 31 |

NYE: A Toast to 2017 |

9 PM |

St Julien Hotel and Spa – 900 Walnut St

Boulder, CO |

by Farley Webmaster | Nov 2, 2016

Ski season opens all across Colorado mountain resorts this month, but if skiing isn’t your cup of tea, you’re sure to find fun elsewhere.

Want to see something on our monthly calendar? Email us at john@john-farley.com.

| Date |

Event |

Time |

Location

|

| Nov 1 |

Brewhouse Yoga

($15 per class; free beer in the tap room) |

Every Tuesday at 6pm |

Sanitas Brewing Co.

3550 Frontier Ave, Boulder, CO 80301 |

| Nov 2 |

History of Visual Arts in Boulder

(Sept 29 – Nov 27)

A $5 donation per person is suggested |

9 AM – 8 PM |

Dairy Arts Center

2590 Walnut Street

(26th & Walnut)

Boulder, Colorado

80302 |

| Nov 3 |

Museum of Boulder Ground Breaking Ceremony

(October 27 – November 16, 2016; FREE) |

8:30 – 9:30 AM |

Museum of Boulder

Event Center

2205 Broadway

Boulder, CO 80302 |

| Nov 4 |

Deck the Mall Holiday Shopping Spectacular

(Nov. 4 & 5; FREE) |

11 AM – 6 PM |

Located on the 16th Street Mall (Denver)

between Arapahoe to Glenarm |

|

FREE Day at the Denver Zoo |

9 AM |

Denver Zoo

2300 Steele Street Denver, CO 80205 |

| Nov 5 |

Boulder Farmer’s Market |

8 AM – 2 PM |

13th Street

next to Central Park

Boulder, CO 80302 |

|

Super Diamond

with Under A Blood Red Sky, The U2 Tribute

($25) |

9 PM |

Ogden Theater

935 E. Colfax Ave.

Denver, CO 80218 |

| Nov 6 |

Great Candy Run |

8:30 AM |

Washington Park

1700 E. Louisiana Avenue, Denver, CO |

| Nov 7 |

Monday night Jazz Jam’s hosted by Brad Goode

(FREE) |

7 – 10 PM |

|

| Nov 8 |

Brewhouse Yoga

($15 per class; free beer in the tap room) |

Every Tuesday at 6pm |

Sanitas Brewing Co.

3550 Frontier Ave, Boulder, CO 80301 |

|

Colorado Avalanche versus Arizona Coyotes |

7 PM |

Pepsi Center

1000 Chopper Circle, Denver, CO 80204 |

| Nov 9 |

Warren Miller Extreme Sports Movies Wednesdays

(February 24 – December 28, 2016; FREE) |

8:30 PM |

West End Tavern

926 Pearl Street

Boulder, CO 80302 |

| Nov 10 |

Denver Nuggets versus Golden State Warriors |

7 PM |

Pepsi Center

1000 Chopper Circle, Denver, CO 80204 |

| Nov 11 |

Free Entry to Black Canyon National Park |

All Day |

Black Canyon of the Gunnison National Park

Montrose, CO 81230 United States

|

| Nov 12 |

Boulder Farmer’s Market |

8 AM – 2 PM |

13th Street

next to Central Park

Boulder, CO 80302 |

|

Children’s Art Workshop: Cabinet of Curiosities

(Ages 6 – 12 / $10 each) |

10:30 AM – 12 PM |

Dairy Arts Center

2590 Walnut Street

(26th & Walnut)

Boulder, Colorado

80302 |

| Nov 13 |

Warren Miller Presents: Here, There & Everywhere

($18.50) |

6 – 9 PM |

|

| Nov 14 |

Morrissey

($75) |

7 PM |

Boulder Theater

2032 14TH ST. [MAP]

BOULDER, CO. 80302 |

| Nov 15 |

Visual Arts Lecture Series: Creativity – Process – Meaning by William Stoehr

A $5 donation per person is suggested |

7 – 8 PM |

Dairy Arts Center

2590 Walnut Street

(26th & Walnut)

Boulder, Colorado

80302 |

| Nov 16 |

The Dustbowl Revival |

7 PM |

Larimer Lounge

2721 Larimer St

Denver |

| Nov 17 |

$20 Thursdays

($20 for 4 pack of tickets) |

9 AM – 5 PM |

110 N Harrison Ave

Lafayette, CO

|

| Nov 18 |

Anthony Bourdain The Hunger 2016 North American Tour |

8 PM |

Bellco Theatre

700 14th Street

Denver, CO 80202

|

| Nov 19 |

Boulder Farmer’s Market |

8 AM – 2 PM |

13th Street

next to Central Park

Boulder, CO 80302 |

|

The Ghosts of Christmas Eve, The Best of Trans-Siberian Orchestra

(tickets start at $43) |

3 PM |

Pepsi Center

1000 Chopper Circle, Denver, CO 80204 |

| Nov 20 |

Switch on the Holidays

(Free) |

5 PM |

1300 Block of Pearl Street |

| Nov 21 |

truTV Impractical Jokers: The Santiago Sent Us Tour |

7 PM |

Temple Hoyne Buell Theater

1400 Curtis St.

Denver, CO 80202 |

| Nov 22 |

Butterfly Pavilion Fall Kids’ Camps

(Nov 21 – 23) |

9 AM – 4 PM |

6252 W 104th Ave

Westminster, CO

|

| Nov 23 |

Let’s Bag Hunger Food Drive

(Nov. 13 – 23) |

9 AM – 7 PM |

King Soopers throughout Boulder, Louisville, Lafayette, Niwot, and Gunbarrel

Louisville, CO

|

| Nov 24 |

HAPPY THANKSGIVING! |

|

|

| Nov 25 |

Catch the Glow Christmas Parade & Celebration

(FREE) |

All day |

Bond Park & area |

| Nov 26 |

Holiday Market and Tree Lighting Ceremony

(FREE) |

12:30 – 5:30 PM |

Winter Park Resort |

| Nov 27 |

Sunday Open House

(additional dates available, see website; FREE) |

10:30 AM – 12 PM |

1345 Spruce Street

Boulder, CO

|

| Nov 28 |

TWO DOOR CINEMA CLUB |

8 PM |

Fillmore Auditorium

1510 N Clarkson St, Denver, CO 80218 |

| Nov 29 |

Colorado Avalanche versus Nashville Predators

(Prices Vary) |

7 PM |

Pepsi Center

1000 Chopper Circle, Denver, CO 80204 |

| Nov 30 |

Big Bad Voodoo Daddy

Wild & Swingin’ Holiday Party!

(18+/$36) |

8 PM |

The Oriental Theater

4335 W. 44th Avenue

Denver |

by John Farley | Oct 28, 2016

What is Home Equity?

Home equity seems to be a very simple calculation — the total amount of mortgages owed subtracted from the current market value of a home. Here is a simple example:

Current Home Market Value $325,000

Existing Mortgage $225,000

Homeowner Equity $100,000

One side of the equation is well defined, and it is found on the monthly mortgage statement, the loan balance. The other side is less obvious — the current market value of the property.

As a homeowner, your down payment purchases your initial equity, and your monthly (or additional) principal payments increase your equity. In strong real estate markets and in-demand locations, equity can increase quite rapidly as the property value increases, but the inverse can also happen — too much available inventory and market down-cycles can lead to falling home values and a reduction in homeowner equity.

It can be difficult to put an accurate value on something that you have emotional and monetary vesting in. It is safe to say that most people think their home is worth more than then it is.

Homeowners can make savvy assessments about their home’s current market value by following the sales of similar properties in the neighborhood, but should stay away from websites such as Zillow and Trulia, which provide inaccurate and outdated estimates. The most accurate measurement requires a comparative market analysis from a real estate professional or having the home professionally appraised. But, the bottom line — your home is worth as much as someone is willing to pay for it.

Creating Value is in Your Hands

Maintaining the condition of a home is vitally important to retaining and increasing value. Homes are judged against their peers: how they compare to similar homes in the neighborhood. Another way to retain value is to not over upgrade, since it is rare to ever recoup the money spent if you exceed neighborhood value. Keep up the landscaping and do the little things to add curb appeal.

Putting Home Equity to Work

Home equity represents the largest single asset of millions of people, and because it represents so much of an individual’s net worth, it must be treated with respect. Home equity is not a liquid asset until a property is sold, or it is borrowed against.

There are two types of loans that tap into homeowner equity as collateral.

Home Equity Loans

Many home equity plans set a fixed period during which the person can borrow money, such as 10 years. At the end of this “draw period,” the person may be allowed to renew the credit line. If the plan does not allow renewals, the homeowner will not be able to borrow additional money once the period has ended. Some plans may call for payment in full of any outstanding balance at the end of the period. Others may allow repayment over a fixed period, for example, of 10 years.

A home equity loan, sometimes called a second mortgage, usually has a fixed rate and a set time to pay it back, generally with equal monthly payments.

Home Equity Line of Credit

A home equity line of credit is similar to a credit card. The lender sets a maximum amount you can borrow, and you can draw money as you need it, though many home equity lines of credit require an initial draw. The interest rate varies daily, and is usually prime plus a set number, but the required payment is usually interest only. Once the loan has been paid down, the payment is reduced, and it can be paid off and initiated as many times as a homeowner requires.

How Much Equity can be Accessed?

Since the financial institution is lending money and using a home as collateral, they will not lend 100% of the home’s equity. The bank does not want to take the risk that if the house price drops, they would be carrying a loan for more than its market value. Therefore, most banks will allow a qualified homeowner to borrow approximately 80% of their equity.

It’s Important to Use Your Home Equity Wisely

Because it is likely the biggest asset most people have, losing your home equity is hard to overcome. It must be used in prudent ways, and the payments against the loan must be affordable. Using equity money to make the loan payment is only acceptable for a short-term solution.

There are number of good reasons to use money from a home equity loan… and some really bad ones. First, let’s cover smart uses.

1. Invest in Your Home

The best way to use the money is create more equity in the home. Among the very best returns on your investment (ROI) include kitchen and bathroom remodels, adding square footage or an extra bath, enhancing curb appeal and repairing/keeping the existing structure sound. Making prudent investments in your home is a wonderful win-win: you enjoy the upgrades and the repairs can add value to the home.

2. Invest in your Children’s Education

Using your home equity to finance a child’s higher education may be the greatest payoff of all. Not only is the rate much lower than a student loan, it is an investment in the child’s future.

3. Supplement Retirement Needs

Older homeowners spent their working lives paying down their mortgage. At retirement, when monthly income is reduced, a home equity loan could pay for a dream vacation or an unexpected major expense.

4. Augment the Impending Sale of a Home

If you’re planning to sell soon, a home equity line of credit may be the best way to finance improvements, and you can pay it off entirely when you sell. Investing wisely on upgrades and repairs may even reap a profit on your investment.

Here are some examples of some not very wise choices.

Adding luxury amenities like a swimming pool, a hot spa, lavish landscaping, expensive appliances and exotic countertops and flooring rarely pay off.

Purchasing a car or boat or most any personal luxury items is a poor use of the funds, since these items quickly depreciate in value.

Also stay away from using money on risk-heavy investments. Financing stock purchases, start-up businesses and paying routine bills is not financially smart. If you cannot afford to purchase those items with available funds, using equity from your home means they should not be in your budget.

You should treat a home equity loan as an investment and not as extra cash when making financial decisions. If your intended use of the money doesn’t pay you back in some way, it’s not the best use of your valuable equity.

We Are Happy to Assist You

If you would like an assessment of the market value of your home and the current equity you can access, give us a call at 303-475-6269 or email 2johnfarley@gmail.com for a comparative market analysis.