HOME BUYING GUIDE

Take the stress out of buying a home

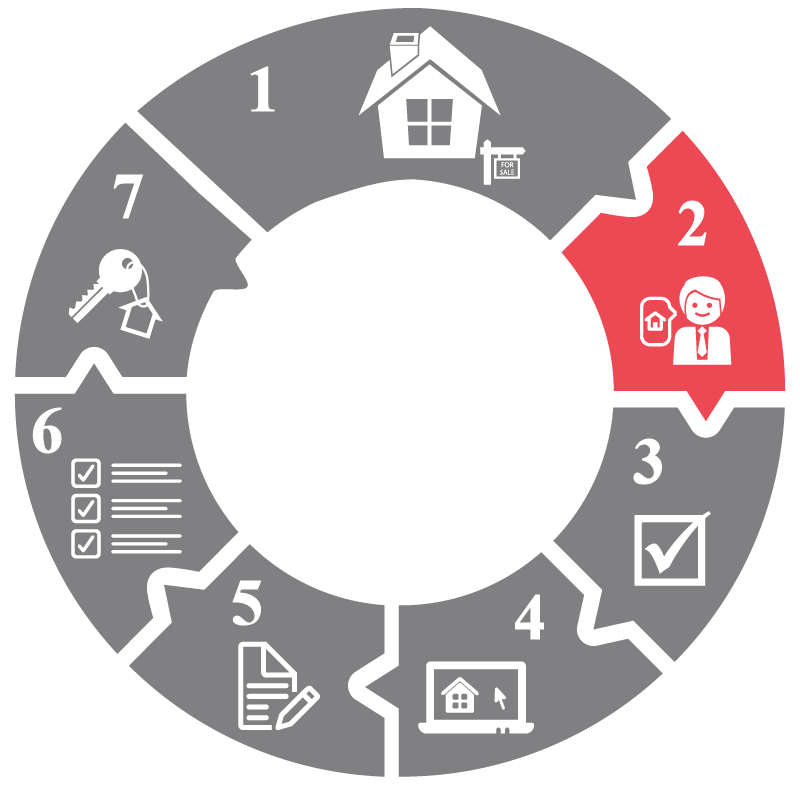

Step 1: Decide to Buy A Home

Step 2: Meet with John Farley, Realtor & EcoBroker

Step 3: Get Pre-Approved

Step 4: Search Online & Off

Step 5: Submit an Offer

Step 6: Contract to Closing

Step 7: Closing Day & Beyond

Owning versus Renting

While we’re sure you’ve heard the horror stories about underwater mortgages, subprime lending and foreclosures, you shouldn’t be scared. Owning a home is part of the classic American dream for reasons that are as sound today as they ever have been.

Investment

For many people, their home is their biggest financial investment. When you pay your rent, kiss that money goodbye forever. When you pay the principal on your mortgage, you’re really helping yourself by building equity in your investment. Building equity in one of Boulder’s neighborhoods is a smart choice! Boulder offers a lifestyle rivaled by few.

Tax Deductions

On April 15, you’ll actually look at your mortgage and smile. The interest you pay on your home loan is tax deductible. The same goes for your property taxes. Your rent, however, is not.

Freedom

Your home is exactly that, yours! There are no landlords to worry about or fast approaching lease deadlines.