by Farley Webmaster | Nov 15, 2017

“Communities work better (students perform better, crime rates are lower, kids are safer, people live longer)

when neighbors know one another better. Knowing your neighbor on a first-name basis…

is a surprisingly effective first step.”

– Robert Putnam, Harvard Public Policy Professor and author of Bowling Alone

While advancements in technology have made it possible for us to connect with people from around the world, numerous studies show that it has led to a decline in face-to-face interactions.1

Places where we used to strike up casual conversations—such as a doctor’s office waiting room, bus stop or grocery line—are now filled with people looking at their smart phones, barely acknowledging those around them.

Even many families dining together or relaxing in the evenings can be caught spending more time focused on screens than each other. Is it any surprise that we’ve experienced a steady decline in community involvement?

In his book Bowling Alone, Harvard Public Policy Professor Robert Putnam “draws on evidence including nearly 500,000 interviews over the last quarter century to show that we sign fewer petitions, belong to fewer organizations that meet, know our neighbors less, meet with friends less frequently, and even socialize with our families less often.”2

How is this shift impacting our overall well being? A study by Oregon Health & Science University researchers found that having limited face-to-face social contact nearly doubles an individual’s risk of depression.3

CONNECTING WITH YOUR COMMUNITY

If you’re considering a move to a new city or neighborhood, you may be worried about replacing the comfort and support of family and friends you’ll leave behind. Or perhaps you have completed a move but would like to meet more people, build friendships and strengthen your support system.

In this blog post, we’ll explore 10 ways you can utilize technology to foster in-person connections with your neighbors, make friends and get engaged in your local community.

1. JOIN YOUR NEIGHBORHOOD’S SOCIAL NETWORK

A growing number of neighborhoods are utilizing private social networks like U.S.-based Nextdoor and Canadian-based GoNeighbour. These platforms are designed specifically to connect neighbors and include an address verification process.

Residents post about a variety of topics, including neighborhood news, recommendations for local businesses, lost pets, etc. These platforms are a great way to stay up-to-date on what’s happening in your neighborhood, but don’t just use them to connect virtually. Extend an invitation to your neighbors to attend an in-person event, such as a park playdate for families, an informal soccer game or a potluck block party.

2. ATTEND A PLACE OF WORSHIP

If you have a religious affiliation, joining a local place of worship is great way to meet people and get involved in your community. Aside from attending services, most religious institutions also host extracurricular activities to foster fellowship amongst the congregation.

Whether you are looking to join a church, synagogue, mosque or temple, there are a variety of online resources available to help you find a match in your area, including:

To make the most of your affiliation, look for opportunities to meet in smaller group settings. It’s a great way to form interpersonal relationships with people who share your beliefs and values.

3. FIND AN INTEREST GROUP

Whatever your favorite hobby or pastime, you’re guaranteed to meet people who share your interests when you join an interest group!

The website Meetup.com has over 32 million members in 288,000 groups in 182 countries. You can search for a group in your area that appeals to you … from book clubs to running groups to professional networking, they have it all.

If you don’t find what you’re looking for, you can start your own group for a monthly fee. The site makes it easy to ask (or require) members to pitch in to cover the cost. It also enables you to promote a corporate sponsor on your page, so you may be able to find a local business to cover the cost.

Most people who join Meetup are there for the same reason you are … to meet people who share their interests. So it’s a great place to make like-minded friends in your community.

4. LEND A HAND

Volunteering your time and talents is another good way to get engaged in your community and meet those who share a similar mission.

Most nonprofit organizations rely heavily on volunteers. Find one with a cause you’re passionate about by visiting VolunteerMatch.

You can search by cause, location and keywords, and filter your results to include opportunities that are suitable for kids, seniors or groups. Another option is to search for volunteer positions that require specialized skills. Perhaps you’re musical or maybe you’re good with computers. There could be an organization in your area that needs your talents or skills.

Lotsa Helping Hands is another site focused on connecting volunteers with those in need. Members can request help or search for opportunities to assist others in their area. Most of the volunteer opportunities involve aiding neighbors who are ill or elderly by delivering meals, offering rides to appointments or just stopping by for a visit. This can be a great way to make a direct impact on your neighbors who need a helping hand!

5. TAKE A CLASS

Taking a class is a wonderful way to develop a skill while meeting people who share your interests and passion for learning.

Whether you want to brush up on your Spanish, finish your novel, or learn how to tango, most community colleges offer inexpensive, non-credit classes on a variety of topics.

And if you are pursuing a degree, forego taking your courses online. Opt for the traditional route instead. There’s no substitute for being part of a live community of your peers.

To search for a community college in your area, visit the American Association of Community Colleges or SchoolsInCanada.com.

6. ATTEND AN EVENT

Attending a live event is another way to engage with members of your community. From festivals to fundraisers to retreats, Eventbrite is a great place to search for events in your area. You can filter your search by category, event type, date and price to find something that fits your interests, schedule and budget.

Be strategic about the type of event you choose. For example, while attending a large festival might be a fun way to feel engaged with your community, it might also be harder to meet people. A retreat or a networking event may offer more opportunities for one-on-one interaction.

7. SHARE YOUR STUFF

Everyone’s talking about the rise of the “sharing economy” with the popularity of Uber and Airbnb. But there’s also been a rise in “sharing communities,” which facilitate the free exchange of goods among neighbors to reduce consumption and keep usable items out of landfills.

Nonprofit groups like The Freecycle Network are made up of people who are giving (and getting) stuff for free in their own towns and neighborhoods. Members can post “offers” of free items or “wanted” items they need.

The company Peerby has a similar goal of reducing consumption by encouraging neighbors to lend and borrow items they don’t often use. For example, you can offer to share your blender, rake or ladder. Maybe you need to borrow a drill, cake pan or moving trolley. Peerby enables you to request items to borrow from your neighbors and encourages you to register items you are willing to lend.

The Little Free Library is another innovative way neighbors are participating in a sharing community. Stewards build or purchase a box to house the library and fill it with books they are willing to give away. The library is usually placed in their front yard or in a public outdoor space. Visitors are encouraged to take a book they’d like to read, and in exchange leave a book for someone else to enjoy. With over 60,000 libraries in 80 countries, the organization estimates millions of books are exchanged annually among neighbors.

8. SUPPORT A COMMUNITY GARDEN

Community gardens have become increasingly popular in both urban and rural areas across North America. Not only do they beautify a neighborhood, they also foster community, encourage self-reliance, reduce family food budgets, conserve resources, and provide opportunities for recreation and exercise.

The mission of the American Community Gardening Association is to build community by increasing and enhancing community gardening and greening across the United States and Canada. The organization’s website enables you to search for existing community gardens in your area. If there isn’t one nearby, you might considering starting one. The site provides helpful tips and resources for organizing a garden in your neighborhood.

9. CARPOOL WITH A COWORKER

In the spirit of joining a “sharing community,” carpooling offers many similar benefits. It presents an opportunity to form a bond with coworkers and/or neighbors during your daily commute. Additionally, you can save money on gas, reduce wear-and-tear on your vehicle, lower carbon emissions, and in many cities reduce your commute time by taking advantage of high-occupancy vehicle (HOV) travel lanes.

The success of ridesharing companies like Uber and Lyft has spurred a new wave of carpooling websites and apps that aim to revolutionize the way we commute by making it easier and more convenient to carpool. While many of these are still in their infancy stages, they are expanding into new markets and improving functionality at a rapid pace.

Kangaride Local, Scoop and Waze Carpool are just a few examples, and more are popping up every day. They are currently available in limited markets throughout the United States and Canada, but are becoming prevalent in more cities as residents opt-in. Check to see if any of these are available in your local area.

Alternatively, you can try posting on your neighborhood’s social network to see if one or more of your neighbors are commuting to a nearby location. Take turns driving and start benefiting from all that carpooling has to offer!

10. PARTICIPATE IN WORLD NEIGHBORS DAY

The organizers behind World Neighbors Day promote it as “an invitation to share a moment with your neighbors, to get to know each other better and develop a real sense of community.”

In Canada it’s held on the second Saturday in June, and in the United States it’s held on the third Sunday in September. Participants are encouraged to organize gatherings with their neighbors to build relationships that “form the fabric of our communities.”

You can participate by attending or organizing a gathering in your neighborhood. Examples include: a block party, outdoor movie screening, book exchange, charity bake sale, volleyball game, etc. Anything that brings neighbors together in a fun and relaxed setting is a good choice!

Gatherings can be promoted through your neighborhood’s social media network, blog or listserv, or you can go the old-fashioned route and hand out flyers door-to-door. Whatever you do, be sure to make your gathering inclusive and welcoming to all.

BE A GOOD NEIGHBOR

As with anything in life, you will get out what you put in. It can take time to build lasting and meaningful friendships with your neighbors, but the effort you make is likely to pay off tenfold.

The tried-and-true way to make friends, expand your circle, grow your support system and get engaged in your community? Be a good neighbor yourself.

What are the best ways you’ve found to meet and engage with your neighbors? Share your success stories or challenges in the comments below!

Sources:

- Lengacher, L. (2015) Mobile Technology: Its Effect on Face-to-Face Communication and Interpersonal Interaction. Undergraduate Research Journal for the Human Sciences –

http://www.kon.org/urc/v14/lengacher.html

- Putnam, R. (2000) Bowling Alone. New York: Simon & Schuster –

http://bowlingalone.com/

- Bergland, C. (2015 October 5) Face-to-Face Social Contact Reduces Risk of Depression. Psychology Today

https://www.psychologytoday.com/blog/the-athletes-way/201510/face-face-social-contact-reduces-risk-depression

SaveSave

by Farley Webmaster | Oct 10, 2017

INTRODUCTION

Turn on the television or scroll through Facebook, and chances are you’ll see at least one advertisement for a group or “guru” who promises to teach you how to “get rich quick” through real estate investing. The truth is, much of what they’re selling are high-risk tactics that aren’t a good fit for the average investor. However, there is a way to make steady, predictable, low-risk income through real estate investing. In this blog post, we’ll examine the tried-and-true tactics that can be used to increase your income, pay off debt … even fund your retirement!

WHY INVEST IN REAL ESTATE?

One of the basic principles of real estate investment lies in this fact: everyone needs a place to live. And according to the Bureau of Labor Statistics’ most recent Consumer Expenditures Survey, housing is typically an American’s largest expense.1

But there are other reasons why real estate is a great investment choice, and we’ve outlined the top five below:

1. Appreciation

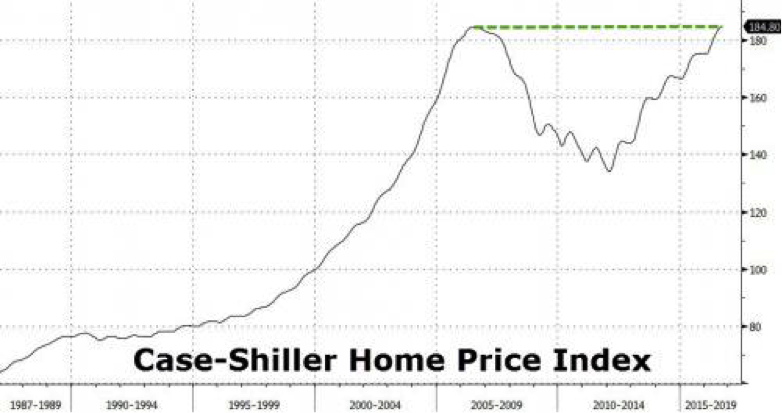

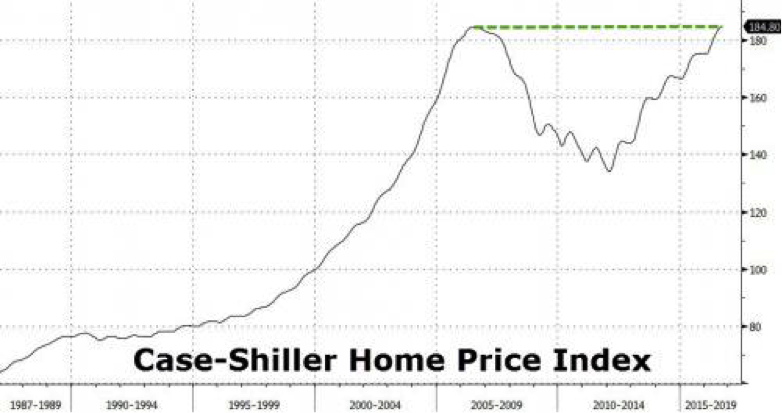

Appreciation is the increase in your property’s value over time. History has proven that over an extended period of time, the value of real estate continues to rise. That doesn’t mean recessions won’t occur. The real estate market is cyclical, and market ups and downs are natural. In fact, the U.S. housing market took a sharp downturn in 2008, and many properties took several years to recover their value. However, in the vast majority of markets, the value of real estate does grow over the long term.

The S&P CoreLogic Case-Shiller National Home Price Index, which tracks U.S. residential real estate prices, released its latest results on August 29 with the headline “National Home Price Index Rises Again to All Time High.”2

Source: ZeroHedge3

While no investment is without risk, real estate has proven again and again to be a solid choice to invest your money over the long term.

2. Hedge Against Inflation

Inflation is the rate at which the general cost of goods and services rises. As inflation rises, prices go up. This means the money you have in your bank account is essentially worth less because your purchasing power has decreased.

Luckily, real estate prices also rise when inflation increases. That means any money you have invested in real estate will rise with (or often exceed) the rate of inflation. Therefore, real estate is a smart place to put your money to guard against inflation.

3. Cash Flow

One of the big benefits of investing in real estate over the stock market is its ability to provide a fairly steady and predictable monthly cash flow. That is, if you choose to rent out your investment property to a tenant, you can expect to receive a rent payment each month.

If you’ve invested wisely, the rent payment should cover the debt obligation you may have on the property (i.e. mortgage), as well as any repairs and maintenance that are needed. Ideally, the monthly rental income would be great enough to leave you a little extra cash each month, as well. You could use that extra money to pay off the mortgage faster, cover your own household expenses, or save for another investment property.

Even if you only take in enough rent to cover your expenses, a rental property purchase will pay for itself over time. As you pay down the mortgage every month with your rental income, your equity will continue to increase, until you own the property free and clear … leaving you with residual cash flow for years to come.

As the owner, you will also benefit from the property’s appreciation when it comes time to sell. This can be a great way to save for retirement or even fund a child’s college education. Purchase a property when the child is young, and with a little discipline, it can be paid off by the time they are ready to go to college. You can sell it for a lump sum, or use the monthly income to pay their tuition and expenses.

4. Leverage

One of the unique features that sets real estate apart from other asset classes is the ability to leverage your investment. Leverage is the use of borrowed capital to increase the potential return of an investment.

For example, if you purchase an investment property for $100,000, you might put 10% down ($10,000) and borrow the remaining $90,000 in the form of a mortgage.

Even though you’ve only invested $10,000 at this point, you have the ability to earn a profit on the entire $100,000 investment. So, if the property appreciates to $120,000 – a 20% increase over the purchase price – you still only have to pay the bank back the original $90,000 (plus interest) … and you get to keep the $20,000 profit.

That means you made $20,000 off of a $10,000 investment, essentially doubling your money, even though the market only went up by 20%! That’s the power of leverage.

5. Tax Advantages

One of the top reasons to invest in real estate is the tax benefit. There are numerous ways a real estate investment can save you money each year on taxes:

Depreciation

When you record your income from a rental property on your annual tax return, you get to deduct any expenses associated with the investment. This includes interest paid on the mortgage, maintenance, repairs and improvements, but it also includes something called depreciation.

Depreciation is the theoretical loss your property suffers each year due to aging. While it’s true that as a home ages it will structurally need repairs and systems will eventually need to be replaced, we’ve also learned in this post that the value of real estate appreciates over time. So getting to claim a “loss” on your investment that is actually gaining in value makes real estate an appealing investment choice.

Serial Home Selling

Even if you’re not interested in owning a rental property, other types of real estate investments offer tax advantages, as well. Generally, when you own an investment property you pay a capital gains tax on any profits you make when you sell the property.

However, when you sell your principal residence, you are exempt from paying taxes on capital gains (up to $250,000 for singles and $500,000 for couples). The Internal Revenue Service (IRS) only requires that you live in the house for two of the previous five years. That means you can purchase an investment property, live in it while you remodel it, and then sell it for a tax-free profit two years later. This can be a great way to get started in real estate investing.

Section 1031 Exchanges

In addition to profiting off of your personal residence tax free, it is possible to sell an investment property tax free if you do it through a 1031 Exchange. If structured properly, the IRS Tax Code enables an investor to sell a property and reinvest the proceeds in a new property while deferring all capital gains taxes.

Tax-Deferred Retirement Account

It’s a common misconception that you can only purchase financial instruments (i.e. stocks, bonds, mutual funds, etc.) through an Individual Retirement Account (IRA) or 401(k). In actuality, the IRS allows individuals to invest retirement funds in real estate and other alternative types of investments, as well. By purchasing your investment property through an IRA, you can take advantage of all of the tax savings these accounts offer.

Be sure to consult a tax professional regarding all tax matters related to your real estate investments. If structured correctly, the profits you earn on your real estate investments can be largely shielded from tax liability. Just another reason to choose real estate as your preferred investment vehicle.

TYPES OF REAL ESTATE INVESTMENTS

While there are numerous ways to invest in real estate, we’re going to focus on three primary ways average investors earn money through real estate. We touched on several of these already in the previous section.

1. Remodel and Resell

HGTV has countless “reality” shows featuring property flippers who make this investment strategy look easy. Commonly referred to as a “Fix and Flip,” investors purchase a property with the intention of remodeling it in a short period of time, with the hope of selling it quickly for a profit.

This is a higher-risk tactic, and one for which many of the real estate “gurus” we talked about earlier claim to have the magic formula. They promise huge profits in a short amount of time. But investors need to understand the risks involved, and be prepared financially to cover additional expenses that may arise.

Luckily, an experienced real estate agent can help you identify properties that may be good candidates for this type of investment strategy… and help you avoid some of the pitfalls that could derail your plans.

2. Traditional Rental

One of the more conservative choices for investing in real estate is to purchase a rental property. The appeal of a rental property is that you can generate cash flow to cover the expenses, while taking advantage of the property’s long-term appreciation in value, and the tax benefits of investing in real estate. It’s a win-win, and a great way for first-time investors to get started.

And according to the U.S. Bureau of Labor Statistics, rents for primary residences have increased 21.9 percent between 2007 and 2015 as demand for rental units continues to grow.1

3. Short-term Rental

With the huge movement toward a “sharing economy,” platforms that facilitate short-term rentals, like Airbnb and HomeAway, are booming. Their popularity has spurred a growing trend toward dual-purpose vacation homes, which owners use themselves part of the year, and rent out the remainder of the time. There are also a growing number of investors purchasing single-family homes for the sole purpose of leasing them on these sites.

Short-term rentals offer several benefits over traditional rentals, which many investors find attractive, including flexibility and higher profit margins. However, the most profitable properties are strategically located near popular tourist destinations. You’ll need an experienced real estate professional to help you identify the right property if you want to be successful in this highly-competitive market.

DOES REAL ESTATE INVESTING SOUND TOO GOOD TO BE TRUE?

We’ve all heard stories, or maybe even know someone, who struck it rich with a well-timed real estate purchase. However, just like any investment strategy, a high potential for earnings often goes hand-in-hand with an increase in risk. Still, there’s substantial evidence that a well-executed real estate investment can be one of the best choices for your money.

Purchasing a home to remodel and resell can be highly profitable, as long as you have a trusted team in place to complete the remodel quickly and within budget … and the financial means to carry the property for a few extra months if delays occur.

Or, if you buy a house for appreciation and cash flow, you can ride through the market ups and downs without stress because you know your property value is bound to increase over time, and your expenses are covered by your rental income.

In either scenario, make sure you’re working with a real estate agent who has knowledge of the investment market and can guide you through the process. While no investment is without risk, a conservative and well-planned investment in real estate can supplement your income and set you up for future financial security.

If you are considering an investment in real estate, please contact us at 303.475.6269 or john@john-farley.com to set up a free consultation. We have experience working with all types of investors and can help you determine the best strategy to meet your investment goals.

Sources:

- Bureau of Labor Statistics Consumer Expenditure Survey Annual Report – https://www.bls.gov/opub/reports/consumer-expenditures/2015/home.htm

- S&P Dow Jones Indices Press Release –

https://www.spice-indices.com/idpfiles/spice-assets/resources/public/documents/574349_cshomeprice-release-0829.pdf?force_download=true

- Durden, T. (2016 November 29). US Home Prices Rise Above July 2006 Levels, Hit New Record High [blog post] ZeroHedge –

http://www.zerohedge.com/news/2016-11-29/us-home-prices-rise-above-july-2006-levels-hit-new-record-hig

h

SaveSave

by Farley Webmaster | Sep 14, 2017

When you’re buying or selling a home, it’s crucial to work with a qualified real estate agent. Not just a professional, but an amazing agent and a market expert. So how do you ensure you’re hiring an amazing real estate agent?

There are currently more than two million real estate professionals in North America.1,2 With so many options to choose from, how does a prospective home buyer or seller choose the right agent or broker? According to the National Association of Realtors®, trust and reputation are the top deciding factors consumers use when hiring an agent.3

But how do you measure trust and reputation … and what criteria can be used to help you make your decision?

In this guide, we’ve outlined the top attributes that amazing agents possess, as well as the questions you can ask to make sure you’re working with the right market expert to achieve your real estate goals.

5 ATTRIBUTES OF AN AMAZING AGENT

Not all real estate professionals are the same. Following are five key attributes of amazing agents to help you understand what makes top agents and market experts stand apart from the competition:

1. A Pricing Specialist: For buyers, amazing agents have a strong understanding of market trends to help you identify and secure a deal to ensure you get the home you want, within your desired budget. For sellers, market experts have experience pricing homes optimally for the market, helping you sell for your desired price, and avoid costs like additional mortgage and utility payments.

Takeaway: Whether buying or selling a home, pricing can be tricky. Market experts can help navigate best-possible pricing strategies, and also secure the home you want within your budget.

2. An Effective Time Manager: The average agent may not be utilizing the latest tools and technology to make the transaction easier and more cost effective for you. Market experts have tools and strategies at their disposal to minimize the amount of time you spend on the process. For sellers, they can also ensure you only deal with qualified buyers, not “window shoppers” who waste your time. For buyers, a market expert knows how to prioritize your needs and wants to find you the ideal home within your budget, without wasting your time on houses that aren’t a fit or are likely turn up major issues in an inspection.

Takeaway: Even a well-intentioned agent may not have the skills, tools or technology to make the experience easy for you. There are lots of hidden activities that may take up unexpected time, and a market expert will save you time and energy.

3. A Market Insider: While most agents can pull market stats about a neighborhood, community or city, they may not understand important trends or developments that would affect your transaction. Market experts live and breathe local real estate and know the trigger points for buying and selling in your market. We also stay current on effective marketing and negotiation practices, resulting in our track record of success.

Takeaway: An experienced real estate agent is often the best source of information about a city, neighborhood, or even street … we’re literally conducting market research every day.

4. A Strong Negotiator: Amazing agents truly set themselves apart in their ability to negotiate. Real estate negotiations take skill, experience and a knowledge of how to fight for your client’s best interests. While any agent can enter negotiations to buy or sell a home, experienced Realtors understand what to do before entering negotiations (establishing the upper hand), as well as during the process (when to offer or accept concessions) in order to set up the best outcome.

Takeaway: Working with a market expert will help ensure you get the best deal on your terms, not just the fastest deal.

5. An Effective Closer: Closing a deal fast is often a good thing. However, top real estate professionals know how to not only achieve your real estate goals quickly, but in the right way to avoid pitfalls. Just like negotiations, the paperwork and process of closing a real estate transaction are complicated. Market experts have a strong understanding of the contracts, timelines, clauses and contingencies within the closing process.

Takeaway: Real estate transactions often involve a significant investment, so even a small mistake can mean serious trouble. With that in mind, it’s best to work with a true market expert.

5 QUESTIONS TO ASK YOUR REAL ESTATE AGENT

The first step would be to “shop around.” Many people work with the first agent they come across without a firm understanding of their level of experience. It’s always a good idea to interview a number of agents before selecting one. If you’ve gotten referrals from people you trust, then you may only need to interview 2-3 agents.

However, it can be tough to know what to ask in the interview process. Here are some questions that can help you qualify the best agent to help you achieve your real estate goals:

1. Can you send me some information about yourself? Look for professionalism and consistency. What are their accomplishments? See how they approach their work. If they’re a newer agent, ask about their team’s dynamic and accomplishments.

2. How long have you been in real estate? While longevity is important, even more telling are the number of transactions they have closed or been involved in. So feel free to also ask: “How many homes have you sold in this area?”

3. What will you do to keep me informed? Will the agent be able to meet your expectations? Determine how much communication you want, and then find an agent who will give you the attention and time you deserve.

4. Can you provide me with further resources I may need? From market reports and pricing trends to school performance and crime statistics, top agents should have resources at their disposal … or know where to find them.

5. Seller only: Can you share with me your plan to market my property? Many agents will simply put your home in the MLS and wait for it to sell. An amazing agent should have a detailed plan of how to get your home exposure on social media, to their local networks, and more.

GET STARTED

Now that you’re armed with the 5 Attributes of Amazing Agents and the Top Questions to ensure you work with the best possible real estate agent, you’re ready to start interviewing agents.

We’d love an opportunity to win your business. Schedule a free consultation with us to find out how true market experts can help you achieve your real estate goals!

Sources:

1. National Association of REALTORS –

https://www.nar.realtor/field-guides/field-guide-to-quick-real-estate-statistics

2. Financial Post –

http://business.financialpost.com/personal-finance/mortgages-real-estate/canada-housing-bubble-agents/wcm/b49d4e3a-bd8d-4d1c-9566-bd3d80c8e23a

3. National Association of REALTORS –

https://www.nar.realtor/reports/highlights-from-the-profile-of-home-buyers-and-sellers

by Farley Webmaster | Aug 30, 2017

More than 77 percent of people own a smartphone.1 The average person checks their smartphone 46 times a day, with people under the age of 24 checking it an average of 74 times a day.1 We check it while we’re waiting in line and during our leisure time, whether we’re scrolling through social media, reading emails or getting up-to-date on the latest news.

Smartphones are not only a useful tool for communication. With the following apps, you can get organized (whether you plan to buy or sell), save money, learn about the homes in your neighborhood and get inspired for your next renovation project. If you’re like 81 percent of people, you have your smartphone with you during most of your waking hours; let it help you stay organized and make your life easier.3

Apps For Homeowners: Get Renovation Inspiration

These apps not only offer ideas for your next remodel or home décor project, some of them even give you a preview of what your home may look like once it’s finished.

1.) Houzz (Free)

The Houzz app is the number one app for home design and it’s no wonder; the app gives you access to all the inspiration, blogs and design ideas from the Houzz site on your phone or tablet. The app features View in My Room 3D, which allows you to view products in your home before you buy. Just take a photo of the space and a 3D version of the product will appear. Browse products, save photos of designs you’d like to view later and connect with local professionals in your area. Whether you’re gathering ideas for your next renovation and décor project or you’re just browsing, the Houzz app will satisfy all your design needs. (Android, iOS)

2.) iHandy Carpenter ($1.99)

Make sure the photos, shelves, mirrors and other artwork you hang are even and aligned with this helpful app. It’s an all-in-one tool kit that features a plumb bob, surface level, bubble level bar, ruler and protractor. No need to purchase these tools separately; just hold your smartphone up to the wall and the app will take care of the rest. (iOS, Android)

3.) Color911 ($3.99)

If you’re thinking of changing the color scheme of your home or want to find the right shades for lamp shades, rugs or throw pillows to match your vintage sofa, the Color911 app provides pre-selected color palettes to match any color scheme. Take a photo of the room or the furniture and the app will create a custom palette full of complementary colors. Write notes about your palette and organize it all into folders to share with family, friends or your design professional. (iOS)

Bonus Apps for Homeowners:

AroundMe (Free)

Hungry and looking for a local hotspot? Meeting friends at a coffee shop nearby? Or just need to find the closest ATM? AroundMe allows you to search for the nearest restaurants, banks, gas stations, book a hotel or find a movie schedule close to where you live. Open the app and start learning more about your neighborhood. (iOS, Android, Windows)

BrightNest (Free)

From keeping things clean to making them colorful, Brightnest, developed by Angie’s List, is loaded with suggestions on how to make your home a better place to live. With categories of customized tips (money-saving, cleaning, eco-friendly, healthy, cooking, and creative) there are plenty of great ways to pull inspiration from the app. BrightNest will help you tackle important home tasks with easy-to-follow instructions, a personal schedule and helpful reminders. (iOS, Android, Web)

Apps For Sellers: List & Sell Your Home Quickly

Are you a homeowner who is thinking of selling? If you’re preparing to sell, you know there are a lot of tasks to complete before putting your home on the market. These apps help you manage your to-dos so you can list and sell your home more efficiently with fewer distractions.

4.) Homesnap (Free)

Using the Homesnap app, you can snap a photo of any home, nationwide, to learn more about it. When you’re ready to sell, snap a few of the homes in your neighborhood to find out their valuation. This app isn’t perfect, which is why you should always consult with a local real estate agent. However, it can give you a general idea of the value of your home compared to others in the neighborhood. (iOS and Android devices)

5.) Docusign (Free)

Use the DocuSign app to complete approvals and agreements in hours—not days—from anywhere and on any device. Quickly and securely access and sign any documents. The benefit to using the app (over your desktop computer) is you will receive push notifications when a document is waiting for your signature and you can view and organize all your docs on-the-go. Using the easily downloadable app, receive and sign documents for free. You can receive and sign documents for free, but will need a paid account to send documents; pricing starts at $10 a month. (iOS, Android, Windows, Web).

6.) Wunderlist (Free)

Designed for use on the Web and mobile devices, Wunderlist is a well-designed to-do list and task management program that makes it easy to create a list and add tasks, due dates and reminders. Organize your ideas or focus into separate lists or create tasks within one list. You can also email them with whomever you collaborate, such as a spouse or your real estate agent. (Android, iOS, Windows Phone, Web)

Bonus App for Sellers:

Real Estate Dictionary (Free)

Not sure what all those industry specific terms mean? Search thousands of words and phrases from real estate, mortgage, and financial dictionaries for clear, in-depth definitions. This is a handy app for anyone who’s buying or selling and wants to learn more about the process. (iOS, Android)

Apps For Renters: Get Ready to Buy

Not ready to buy a home just yet? These apps will help you get into the perfect rental while you save money, build a budget and get on track for homeownership.

7.) Mint (Free)

Do you know where your money goes each month? Manage your bills, budget and credit score all in one place. Mint is a free app that helps you view your complete financial picture and track your spending. We recommend this app to anyone, but it’s especially useful for renters who need to crack down on their spending in order to save for a down payment. Use Mint to look for areas you can cut spending in order to save a little extra each month. (iOS, Android)

8.) Acorns ($1 a month to start)

Acorns is modernizing the practice of saving loose change with their automated savings tool. The app rounds up your purchases on linked credit or debit cards, then sweeps the change into a computer-managed investment portfolio. Acorns is free for four years for college students and everyone else pays $1 a month until their account balance hits $5,000, then 0.25% of their account balance per year. This is a useful tool for those who have a hard time saving. (iOS, Android)

9.) Neighborhoods & Apartments

Built for the on-the-go apartment hunter, this app from Walk Score takes the hassle out of finding your next home or apartment and helps you live near the people and places you love. They collect listings from top rental listing sites and we like them because they share how walkable each address is, determined by access to public transit, things to do, bike trails, shorter commutes, etc. (iOS, Android)

Bonus Apps for Renters:

Wally (Free)

Wally is a personal finance app that helps you compare your income to expenses, so you can understand where your money goes each month, and set and achieve goals. Wally lets you keep track of the details as you spend money: where, when, what, why, & how much. We love how simple it is to set a personalized savings target and scan receipts. (iOS, Android)

Credit Karma (Free)

If you’re preparing to buy, boosting your credit score is likely a goal you’ve set. Credit Karma is a free app that allows you to safely monitor your score and receive updates on ways you can improve it over time. They provide financial calculators and educational articles to help you better understand what credit is all about. Check as often as you want, and it doesn’t hurt your score. (iOS, Android, Web)

Apps for Buyers: Find the Perfect Home

When you’re ready to buy, there are several apps that can help you stay on top of the process. Whether you’re browsing online at different neighborhoods and homes and can’t seem to remember where all your saved data and information went or you want to save an important task or a neighborhood or listing clipped from the Web, these apps help you keep it all straight.

10.) Dwellr (Free)

Dwellr is run by the U.S Census Bureau and provides demographic information about the neighborhoods you are considering moving to. You get a variety of education/school, real estate, transportation, and population statistics to give you an idea of what it would be like living there. If you want to get the feel of a potential neighborhood, then Dwellr may just be the app to help you find the best home. (iOS, Android)

11.) Evernote (Free for the Basic version, $34.99 per year for Plus and $69.99 per year for Premium)

Collect ideas, notes and images in one place to access later on your computer, tablet or smartphone. Categorize your notes so you can find them quickly and easily and share them with others in a group notebook. Add the Web Clipper feature to your browser and clip and save articles, blogs and images from the Web. Whether you’re collecting research on a business idea or you’re looking for inspiration for a home renovation, Evernote can help you keep it all together. (Web, iOS, Android)

12.) Mortgage Calculator (Free)

There are a lot of free mortgage calculators available for download that will help you quickly determine what your monthly payment will be while you’re house hunting. We recommend picking your favorite and using it to help you shop in your price range. These numbers should be used as a guide, work with your agent and mortgage professional to learn exactly what type of loan you’ll qualify for. (Web, iOS, Android)

Bonus App for Buyers:

Google Maps (Free)

Google Maps is a must-have for anyone who’s house hunting. When you’re ready to visit a property or check out a neighborhood, you can use Google Maps to give you turn by turn directions to the house. You can use their satellite view to get a good idea how far important things like schools, parks, shopping, bus stops, and restaurants are to a home you are interested in and check out the other houses on the street. (Web, Android, iOS,)

Ready to move beyond the app?

If you’re thinking of buying or selling your home, or know someone who is, keep us in mind because we’re happy to help!

Source: 1. Pew Research Center, January 12, 2017 http://www.pewresearch.org/fact-tank/2017/01/12/evolution-of-technology/

- Deloitte, 2016 global mobile consumer survey: US edition https://www2.deloitte.com/us/en/pages/technology-media-and-telecommunications/articles/global-mobile-consumer-survey-us-edition.html

- Gallup, July 9, 2015 http://www.gallup.com/poll/184046/smartphone-owners-check-phone-least-hourly.aspx

by Farley Webmaster | Jul 19, 2017

Understanding a home’s true market value is about more than pictures, software assessments and price-per-square-foot. Whether you’re a current homeowner thinking of selling or are house-hunting, it’s crucial you understand what factors affect home valuation. By partnering with a local market expert, sellers will avoid pricing their house out of the market (the kiss of death in real estate) and buyers will ensure they get a good deal on their next home.

So, how do you accurately calculate a home’s value? After all, the value a home is assigned by its town or county and the one it’s given when it’s listed are often dramatically different from one another. Which one is accurate and what does it all mean? Read on to learn more.

Assessed Value vs Market Value: What’s the difference?

When it comes to home value, you’ll often hear two terms, assessed value and market value.

A home’s assessed value is often the lower number of the two, and is the value given by your municipality or county. Investopedia defines assessed value as “the dollar value assigned to a property to measure applicable taxes.”1 Although property tax laws vary, assessors commonly arrive at this number by taking into account the following:

- What comparable/similar homes are selling for in your area.

- The value of recent improvements.

- Income from renting out a room or space on the property.

- How much it would cost to rebuild on the property.

A home’s market value, or Fair Market Value, is the price a buyer is willing to pay or a seller is willing to accept for a property. A skilled real estate professional will arrive at the value using a variety of metrics, including:

- External characteristics, such as lot size, home style, the condition of the home and curb appeal.

- Internal characteristics, such as the number of rooms and their size, the type and condition of the heating or HVAC system, the quality and condition of construction, the flow of the home, etc.

- The sales price of comparable homes that have sold in your area.

- Supply and demand; that is, how many buyers and sellers are in the area.

- Location; that is, the quality and desirability of your neighborhood and other community amenities.

Why are these values often so different? An assessor usually estimates your property’s market value during a reassessment or if you make a physical change or improvement to it.2 As a result, a property may not be reassessed for many years. While your home’s market value may fluctuate with the market, your home’s assessed value is more likely to remain steady.3

What Determines a Home’s Value?

You’ve likely heard the motto of real estate: “Location, location, location.” This means a home’s value relies on its location. While the home and structures on the property will likely depreciate over time, the land beneath it tends to appreciate. Why? Land is in limited supply and a growing population puts increased demand on the housing supply. As a result, values increase.4

Other factors that affect your home’s value include the function and appearance of the property, how well the home and other structures are maintained and whether the home is a lifestyle property, such as a ranch style with mountain views or beach bungalow.

Ultimately, the best indication of a home’s value is the overall supply and demand of the market. This is why we recommend you partner with a real estate professional who takes all of these factors—the assessed value, local market conditions, home features and has physically walked through and experienced your home— into consideration to determine the most accurate market value.

How to determine if a property is comparable to yours.

Both assessed value and market value are partially determined by the sales price of similar, or comparable, homes in the area. To determine if a home is comparable to yours, look for the following characteristics:

- Lot size

- Square footage

- Home style or similar architecture

- Age

- Location

While you may not find a home with the same exact characteristics as yours, you’ll likely find a few that are close. To account for any disparity, adjust the sales prices of the comparable properties. Look at the differences between your property and the one in question and determine if the differences increased or decreased the sales price and by how much. For example, if your home has two bathrooms and a similar home only has three, estimate how much that extra bathroom increased the sale price of the similar home. The adjusted sale price is the estimation of what the property would sell for if the properties were exactly the same.2

Where can you find comparable sales?

Fortunately, you can find comparable home sales in a variety of places.2

- Your local assessor’s office is able to provide a list of recent sales you can browse and compare or a sales history of a particular house, home style or neighborhood.

- Your municipality. Many cities keep local sales information in their offices or post it online.

- Online databases, such as a real estate database

- Your local newspapers may offer some real estate information in the form of quarterly sales reports in the business or real estate sections of the newspaper.

- Our office. We regularly do Comparable Market Analysis of homes in our local area.

How to calculate your home’s value.

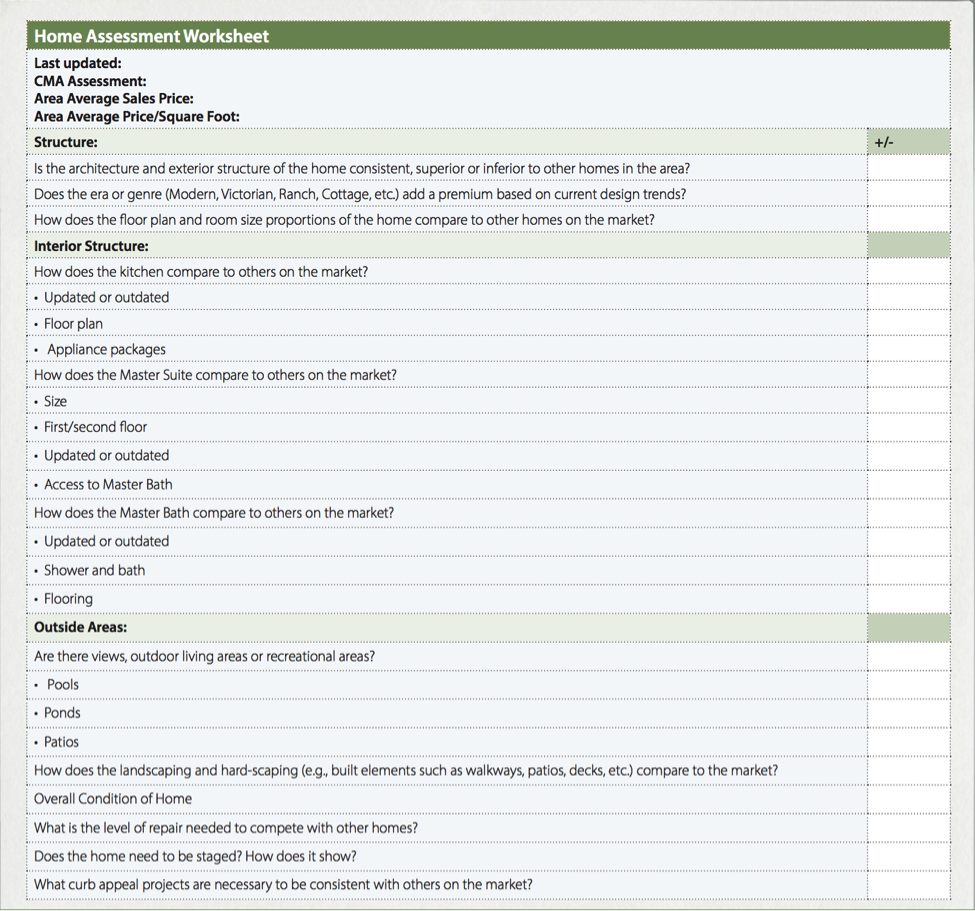

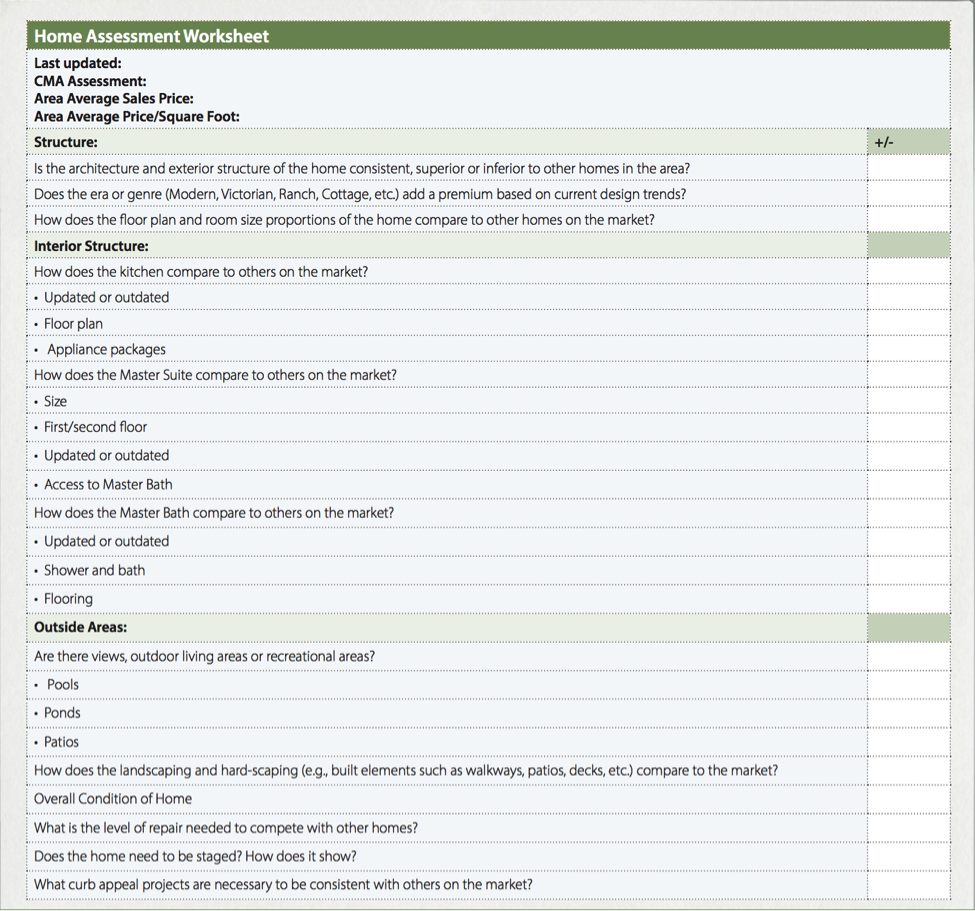

By answering a few questions about your home, property and the local market, you can begin to estimate your property’s value. We’ve also included a worksheet for you below…

Home Value Questions:

When was your home last assessed?

What was its CMA assessment value?

What is your area’s average sales price?

What is your area’s average price/square foot?

Structure:

- Is the architecture and exterior structure of the home consistent, superior or inferior to other homes in the area?

- Does the era or genre (Modern, Victorian, Ranch, Cottage, etc.) add a premium based on current design trends?

- How does the floor plan and room size proportions of the home compare to other homes on the market?

Interior Structure:

- How does the kitchen compare to others on the market?

- Updated or outdated

- Floor plan

- Appliance packages

- How does the Master Suite compare to others on the market?

- Size

- First/second floor

- Updated or outdated

- Access to Master Bath

- How does the Master Bath compare to others on the market?

- Updated or outdated

- Shower and bath

- Flooring

Outside Areas:

- Are there views, outdoor living areas or recreational areas?

- How does the landscaping and hard-scaping compare to the market? (e.g., built elements such as walkways, patios, decks, etc.)

Overall Condition of Home

- What is the level of repair needed to compete with other homes?

- Does the home need to be staged? How does it show?

- What curb appeal projects are necessary to be consistent with others on the market?

Home Assessment Worksheet

If you want to accurately assess a home’s value, it’s crucial to know about the market activity of our local area. We can help! Give us a call at 303-475-6269 to get the scoop on the local market.

Sources:

- Investopedia http://www.investopedia.com/terms/a/assessedvalue.asp

- New York State Department of Taxation and Finance https://www.tax.ny.gov/pubs_and_bulls/orpts/mv_estimates.htm

- Realtor.com http://www.realtor.com/advice/sell/assessed-value-vs-market-value-difference/

- Investopedia, http://www.investopedia.com/articles/mortgages-real-estate/08/housing-appreciation.asp?lgl=myfinance-layout

SaveSave

SaveSave