by Farley Webmaster | Sep 15, 2018

No one likes to think about disasters. Severe weather, fire, theft—or even a seemingly small issue like a broken pipe—can wreak havoc on your home and result in thousands of dollars in damages. Fortunately, a good homeowners insurance policy can offer you peace of mind that you and your family will be financially protected if disaster strikes.

A homeowners insurance policy covers your home—as well as the belongings in it—in case of theft, accidental damage, or certain natural disasters. In fact, most financial institutions require that you purchase homeowners insurance before they issue a mortgage. While coverage varies, most policies also help to protect you from liability should someone outside your household become injured on your property. And that liability coverage is often extended to include damage you (or anyone living in your household) may do to someone else’s property.1

With all the protection offered, it’s equally important to understand what a home insurance policy does NOT cover. For example, homeowners insurance won’t pay to repair malfunctioning systems and appliances within your home. And terms vary, but standard policies typically exclude coverage related to floods, earthquakes, slow leaks, power failure, neglect, aging, faulty repairs or construction materials, and acts of war.2

|

Homeowners Insurance Covers Things Like:

|

Most Standard Policies DON’T Cover:

|

- Structure

- Roof

- Windows

- Furniture/Personal Belongings

- Liability for Non-Residents Injured on Property

- Liability for Damage or Injury Caused by You or Your Pets

|

- Malfunctioning Systems & Appliances

- Floods

- Earthquakes

- Slow Leaks

- Power Failures

- Neglect or Aging

- Faulty Repairs

- Acts of War

|

NARROWING THE COVERAGE GAP

So how do you minimize your risk when so many potential issues are excluded from a standard homeowners policy? Many insurers offer supplemental coverage options that can be tacked on to a basic policy. We explore this further in the section below on “7 Tips for Purchasing Homeowners Insurance.”

Some homeowners also choose to purchase a home warranty, which covers many of the systems and appliances in your home that are NOT covered by homeowners insurance. Home warranties are separate from homeowners insurance, so if interested you’ll need to seek out a policy through a dedicated provider.

While terms vary, a home warranty will often pay to repair or replace components of your HVAC, electrical, plumbing, and some appliances that fail due to age or typical wear and tear. Unlike homeowners insurance, home warranties aren’t required by mortgage companies. But many homeowners like the added financial protection and peace of mind that home warranties provide.3

Keep in mind, if you do purchase a home warranty, you will still be responsible for paying a service fee, or deductible, every time you use it. And you will be limited to using service providers who are contracted through your home warranty company.

7 TIPS FOR PURCHASING HOMEOWNERS INSURANCE

Whether you’re shopping for a new policy on your first home or you’re considering switching providers on an existing policy, it’s important to do your research beforehand. Not all insurance policies—or providers—are created equal. A little due diligence can save you time, money, and hassle in the long run.

1. Prioritize Service and Value

When choosing an insurance provider, ask around for recommendations. Check with neighbors, friends, and family members, particularly those who have filed an insurance claim in the past. Find out if they had a positive or negative experience. Read online reviews. Ask your real estate agent for a referral to a reputable insurance broker who can help you compare your options.

Don’t just choose the cheapest policy. Instead, search for one that offers excellent client service and provides the best coverage for the cost.

2. Choose the Right Level of Coverage

Your policy limits should be high enough to cover the cost of rebuilding your home. Don’t make the common mistake of insuring your home for the price you paid for it. The cost to rebuild could be higher or lower, depending on the value of your land, your home’s unique features, market factors, new building codes, and local construction costs.4

Also, consider whether you need a higher level of liability insurance to protect your assets. If your investments and savings exceed the liability limits in your policy, you may need to purchase an excess liability or umbrella policy.

Ultimately, you should make sure your coverage is adequate to mitigate your losses—but don’t pay for excess insurance you don’t need.

3. Inquire About Additional Coverage

Ask your insurance agent about additional coverage options that can help close any gaps you have in your policy.

For example, if you’re in a flood or earthquake-prone area, experts strongly recommend that you add those coverages to your policy. In fact, flooding is the most frequently occurring natural hazard, and a significant percentage of insurance payouts are for homes outside “flood zones,” or areas known to be at risk of flooding. So even if your home is not technically located in a flood zone, you may want to add flood coverage to your policy, just in case.5

Expensive jewelry, furs, collectibles, or artwork may not be fully insured by a standard policy. Ask about raising your limits for any items of particular value, or check with a specialty insurer about a separate policy for such items.

4. Decide on “Replacement Cost” or “Actual Cash Value”

Insurers can use a variety of methods to determine how much they will pay to reimburse you for a loss, but the two most common are “replacement cost” or “actual cash value.”

If your seven-year-old sofa is damaged in a fire, replacement cost coverage will pay you the cost to purchase a new, comparable sofa at today’s prices. Actual cash value coverage will pay you for the depreciated value of the sofa you lost—so what you would pay to buy a seven-year-old sofa rather than a new one.6

While a replacement cost coverage policy will result in a bigger payoff if you suffer a loss, it will probably require a larger annual premium. Compare both options to find out which is the better fit for you.

5. Consider a Higher Deductible

A deductible is the amount of money you are responsible for paying on a loss before your insurance company will pay a claim. Opting for a higher deductible can reduce your premiums.

Note that in some cases, your insurance policy may have a separate or higher deductible for certain kinds of claims, such as those caused by floods, windstorms, hail, or earthquakes.

While a higher deductible can save you money on your premiums, opt for one that is still affordable given your current financial situation.

6. Try Bundling Your Coverage

Combining your home, automobile, and other policies under one insurer can often result in a significant discount. And some insurers offer additional benefits, such as a single deductible if property insured by multiple policies is damaged. For instance, if a fire destroys your home and your car, you may only have to pay the higher of the two deductibles. Bundling can also make payment and renewal of your policies more convenient.7

However, bundling isn’t always the best or least expensive option. In some cases, you may find better coverage options, service, and/or pricing if you split your policies between multiple insurers. So be sure to consider all of your options before making a final decision.

7. Reassess Your Policy Each Year

Even if you’ve done all your due diligence before purchasing a homeowners insurance policy, don’t set your annual renewal on autopilot. Instead, when it comes time to renew, take some time to consider factors that have changed over the past year.

For example, have you made any home improvements that would require you to raise your coverage limits? Have you made any security or safety improvements that qualify you for a discount on your premiums?8

Has there been a shift in market conditions that would make it more or less expensive to rebuild your home now? If so, you may need to adjust your coverage levels accordingly.

If you’ve made any changes to how you use your home, you may need to adjust your policy, as well. For example, if you’ve started a home-based business or occasionally rent out your home on a home-sharing site, you may not be fully covered by your existing policy.9

Finally, consider any changes to your financial situation that may require increased liability coverage limits. If you’ve grown your investments or inherited property, it may be time to purchase additional coverage to protect your expanding asset base.

MINIMIZE RISK, MAXIMIZE VALUE

Now that you understand the basics of homeowners insurance, you should be ready to start shopping for a policy that best fits your needs and budget. Your goal should be to minimize your risk while maximizing the value your policy provides.

While you never want to leave yourself without a safety net should disaster strike, you also don’t want to overpay for insurance you don’t need (and will hopefully rarely use). Aim to strike a balance that will provide you with adequate protection at an affordable price.

NEED MORE GUIDANCE? WE CAN HELP

If you’re in the market to purchase homeowners insurance or a home warranty, give us a call! We get a lot of feedback from clients on the best (and worst) providers and are happy to share what we know.

We can also put you in touch with a trusted insurance professional who can answer your questions and help you find the best policy to meet your needs.

The above references an opinion and is for informational purposes only. It is not intended to be financial or insurance advice. Consult the appropriate professionals for advice regarding your individual needs.

Sources:

- Insurance Information Institute –

https://www.iii.org/article/what-covered-standard-homeowners-policy

- com –

https://www.insure.com/home-insurance/exclusions.html

- American Home Shield –

https://www.ahs.com/home-matters/cost-savers/whats-the-difference-homeowners-insurance-vs-home-warranty

- Insurance Information Institute –

https://www.iii.org/article/how-much-homeowners-insurance-do-you-need

- com –

https://www.realtor.com/advice/buy/buying-home-insurance

- Texas Department of Insurance –

http://www.helpinsure.com/home/documents/acvvsreplace.pdf

- com –

https://www.insure.com/home-insurance-faq/bundle-insurance-policies.html

- National Association of Insurance Commissioners –

https://www.insureuonline.org/consumer_homeowners_ten_tips.htm

- HomeAway –

https://help.homeaway.com/articles/Do-I-need-a-special-vacation-rental-insurance-policy-for-my-property

by Farley Webmaster | Aug 17, 2018

The residential rental market is now the fastest-growing segment of the housing market. In the United States, the demand for single-family rentals, defined as either detached homes or townhouses, has risen 30 percent in the past three years.1And in Canada, rental units now account for nearly one-third of the country’s homes, with particular demand for multi-family units, including apartments and condominiums.2

At the same time, the short-term, or vacation, rental market is also booming. The popularity of online marketplaces like Airbnb, HomeAway, and VRBO has helped the short-term rental market become one of the fastest-growing segments in the travel industry.3

Now, more than ever, there is an abundance of opportunity for real estate investors. But which path is best: leasing your property to a long-term tenant, or renting your property to travelers on a short-term basis?

In this post, we examine the differences between the two investment strategies and the benefits and limitations of each category.

WHY INVEST IN A RENTAL PROPERTY? The Top 5 Reasons

Before we delve into the differences between long-term and short-term rentals, let’s answer the question: “Why invest in a rental property at all?”

There are five key reasons investors choose to real estate over other investment vehicles:

1. Appreciation

Appreciation is the increase in your property’s value over time. And history has proven that over an extended period, the cost of real estate continues to rise. Recessions may still occur, but in the vast majority of markets, the value of real estate does grow over the long term.

2. Cash Flow

One of the key benefits of investing in real estate is the ability to generate steady cash flow. Rental income can be used to pay the mortgage and taxes on your investment property, as well as regular maintenance and repairs. If appropriately priced in a solid rental market, there may even be a little extra cash each month to help with your living expenses or to grow your savings.

Even if you only take in enough rent to cover your expenses, a rental property purchase will pay for itself over time. As you pay down the mortgage every month with your rental income, your equity will continue to increase until you own the property free and clear … leaving you with residual cash flow for years to come.

3. Hedge Against Inflation

Inflation is the rate at which the general cost of goods and services rises. That means as inflation rises, the money you have sitting in a savings account will buy less tomorrow than it will today. On the other hand, the price of real estate typically matches (or often exceeds) the rate of inflation. To hedge or guard yourself against inflation, real estate can be a smart investment choice.

4. Leverage

Leverage is the use of borrowed capital to increase the potential return of an investment. You can put a relatively small amount down on a property, finance the rest of the investment with a mortgage, and then profit on the entire combined value.

5. Tax Benefits

Don’t overlook the tax benefits that can come with a real estate investment, as well. From deductions to depreciation to exemptions, there are many ways a real estate investment can save you money on taxes. Consult a tax professional to discuss your particular circumstances.

These are just a few of the many perks of investing in real estate. (For more detailed information, visit our previous post: Why Real Estate Investing Makes (Dollars and) Sense. But what’s the best strategy to maximize returns on your investment property? In the next section, we explore the differences between long-term and short-term rentals.

LONG-TERM (TRADITIONAL) RENTAL MARKET

When most people think of owning a rental property, they imagine buying a home and renting it out to tenants to use as their primary residence. Traditionally, investors would use their rental property to generate an additional stream of income while benefiting from the property’s long-term appreciation in value.

In fact, that steady and predictable monthly cash flow is one of the key advantages of owning a long-term rental. And as an owner, you don’t usually have to worry about paying the utility bills or furnishing the property—both of which are typically covered by the tenant. Add to this the fact that traditional tenants translate into less time and effort spent on day-to-day property management, and long-term rentals are an attractive option for many investors.

However, there are also limitations to long-term rentals, which often come down to your ability to control the property. Perhaps the most obvious one is that you do not get to use the home or closely monitor its upkeep (this is different from a short-term rental, which we’ll share in the next section).

In addition, while you can usually generate a steady, predictable income stream with a long-term rental, you are limited in your ability to adjust rent prices based on increasing or seasonal demand. Therefore, you may end up with a lower overall return on your investment. In fact, according to data from Mashvisor, in the 10 hottest real estate markets, short-term rentals produced “significantly higher rental income” than long-term rentals.4

SHORT-TERM (VACATION) RENTAL MARKET

Short-term rentals are often referred to as vacation rentals, as more and more travelers enjoy the benefits of staying in a home while on vacation. In fact, according to Wells Fargo, vacation rentals are steadily growing and predicted to account for 21% of the worldwide accommodations market by 2020.5

Investing in a short-term rental or funding your second-home purchase by renting it out can offer many benefits. If you purchase an investment property in a top travel destination or vacation spot, you can expect steady demand from travelers while taking advantage of any non-rented periods to enjoy the home yourself. In addition to greater control over how your property is used, you can also adjust your rental price around peak travel demand to maximize your returns.

But short-term rentals also have risks and drawbacks that may dissuade some investors. They require greater day-to-day property management, and owners are typically responsible for furnishing the property, upkeep, and utilities.

And while rental revenue can be higher, it can also be less predictable based on seasonal or consumer travel trends. For example, a lack of snowfall during ski season could mean fewer bookings and lower rental revenue that year.

In addition, laws and limitations on short-term rentals can vary by region. And in some areas, the regulations are in flux as residents and government officials adapt to a new surge in short-term rentals. So make sure you understand any existing or proposed restrictions on rentals in the area where you want to invest.

Urban centers or suburban communities may be more resistant to short-term renters, thus more likely to pass future limitations on use. To lower your risk, you may want to consider properties in resort communities that are accustomed to travelers. We can help you assess the current regulations on short-term rentals in the Boulder area. Or if you’re interested in investing in another market, we can refer you to a local agent who can help.

WHICH INVESTMENT STRATEGY IS RIGHT FOR YOU?

Now that you understand these two real estate investment options, how do you pick the right one for you? It’s helpful to start by clarifying your investment goals.

If your goal is to generate steady, predictable income with less time and effort spent on property management, then a long-term rental may be your best option. Also, if you prefer a less-risky investment with more reliable (but possibly lower) returns, then you may be more comfortable with a long-term rental.

On the other hand, if your goal is to purchase a vacation or second home that you’ll use, and you want to defray some (or all) of the expense, then a short-term rental may be a good option for you. Similarly, if you’re open to taking on more risk and revenue volatility for the possibility of greater investment returns, then a short-term rental may better suit your spirit as an investor.

But sometimes the decision isn’t always so clear-cut. If your goal is to purchase a future retirement home now to hedge against inflation, rising real estate prices, and interest rates, then both long- and short-term rentals could be suitable options. In this case, you’ll want to consider other factors like location, market demand, property type, and your risk tolerance.

BOULDER OR ELSEWHERE … WE CAN HELP

If you’re looking to make a real estate investment—whether it’s a primary residence, investment property, vacation home, or future retirement home—give us a call. We’ll help you determine the best course of action and share insights and resources to help you make an informed decision. And if your plans include buying outside of our area, we can refer you to a local agent who can help. Contact us to schedule a free consultation!

The above references an opinion and is for informational purposes only. It is not intended to be financial advice. Consult the appropriate professionals for advice regarding your individual needs.

Sources:

- USA Today –

https://www.usatoday.com/story/money/personalfinance/real-estate/2017/11/11/renting-homes-overtaking-housing-market-heres-why/845474001/

- The Globe and Mail –

https://www.theglobeandmail.com/real-estate/the-market/article-demand-for-rental-housing-in-canada-now-outpacing-home-ownership/

- Phocuswright –

https://www.phocuswright.com/Travel-Research/Research-Updates/2017/US-Private-Accommodation-Market-to-Reach-36B-by-2018

- com –

https://www.rented.com/vacation-rental-best-practices-blog/do-long-term-rentals-or-short-term-rentals-provide-better-investment-returns/

- Turnkey Vacation Rentals –

https://blog.turnkeyvr.com/short-term-vs-long-term-vacation-rental-properties/

by Farley Webmaster | Jul 11, 2018

It’s easy to get swept up in the excitement of buying a home. Once you’ve had an offer accepted on your Boulder dream house, you’ll probably be anxious to move in. However, before you make a significant financial commitment, it’s best to know exactly what you’re buying by getting a home inspection.

When you hire a home inspector, you get a professional, in-depth examination of the property’s structures and systems. It’s a worthwhile investment that can save you money in the long run, either by warning you away from a bad purchase or by providing a list of deficiencies you can use to negotiate with the sellers.

The inspector’s report will also list minor repairs that, if made, will help to maintain your home over the long term. Additionally, a good inspector can often predict the standard life expectancy of your roof, HVAC, and other big-ticket items so you can start planning for their eventual replacement.

However, many buyers make mistakes during the inspection process that cost them time and money and lead to unnecessary stress. Avoid these eight common buyer blunders to minimize your risk, protect your investment, and give yourself peace of mind and confidence in your new home purchase.

MISTAKE 1: Skip Your Own Inspection

Many buyers rely on their home inspector to point out issues with the property. However, by conducting your own visual assessment before you submit an offer, you can factor expected expenses into the offer price. Or, if you suspect major problems, you may choose to move on to a different property altogether.

Examine the walls and ceilings. Are there suspicious cracks, which could point to a foundation issue? Any discoloration? Yellow spots can indicate water damage, while black spots are typically mold. If there’s a basement, look for powdery white deposits along the walls and slab, which can result from water seepage.1

To assess the plumbing, start by turning on a bathroom sink or tub, then flushing the toilet. Check for a drop in water pressure or a gurgling sound coming from the pipes. You can also try running the water in sinks and tubs for several minutes to test for drainage issues. Peak underneath sinks to spot signs of leaks or drain pipes that go into the floor instead of the wall.1

Look for fogged or drafty windows, which may need replacing. Examine the roof for signs of cupped, curled, or cracked shingles. Check siding, decks, and other wooden structures for evidence of rot.

Overall, does the home appear to be well maintained? Unless it’s a highly-competitive seller’s market, consider the overall condition of the property BEFORE you submit an offer. Work with your real estate agent to factor in repairs and updates you know you’ll need to make when you determine your offer price.

MISTAKE 2: Hire the Cheapest Inspector

We all love to save money, but not all inspectors are created equal. Before you hire one, do a little research.2 You may even want to start shopping for an inspector before you complete your home search. Inspection periods are typically short, so it never hurts to be prepared.

You can start by asking around for recommendations. Check with friends and family members, as well as your real estate agent. Then contact at least two or three inspectors so you can compare not only price but also levels of experience and service.

Ask about their background, years of experience, and the number of inspections they have completed. Verify their certifications and credentials, and make sure they carry the proper insurance.

Find out what is (and what isn’t) covered in the inspection and if they utilize the latest technology. Ask to see a sample report so you can compare the style and level of detail provided. Finally, make sure you feel confident in the inspector’s abilities and comfortable asking him/her questions.

MISTAKE 3: Miss Attending the Inspection

Make every effort to be on-site during the inspection. Buyers who aren’t present during their inspection miss out on a great opportunity to gather valuable information about their new home.

If can attend the inspection, don’t spend all your time picking out paint colors or chatting with your new neighbors. Instead, use your time there to shadow the inspector. It’s the perfect chance to find out where everything is located, ask questions, and see first-hand what repairs and updates may be needed.3

Of course, if you do choose to tag along with your inspector, exercise good judgment. Don’t get in the way, become a distraction, or do anything to jeopardize your (or the inspector’s) safety.

If you can’t make it to the inspection, ask if you can schedule a time to meet in person or speak by phone to go over the report in detail. It will give you an opportunity to ask questions or request clarification about issues in the report you don’t fully understand.

MISTAKE 4: Skim Over the Report

Inspection reports can be long and tedious, and it can be tempting to skim over them. However, buyers who do this risk missing crucial information.

Instead, you should read over the report carefully, so you don’t miss anything significant. Now is the time to address any areas of concern. You have a limited window of time to request repairs or negotiate the selling price, so don’t squander it.

Your inspector may also flag some minor items that you wouldn’t typically expect a seller to fix. However, ignoring these small issues can sometimes lead to bigger problems down the road. Make sure you read everything in the report so you can take future action if needed.

MISTAKE 5: Avoid Asking Questions

Some buyers are too embarrassed to ask questions when there’s something in the inspection report they don’t understand. Afraid they might look foolish, they avoid asking questions and end up uninformed about important issues that could impact their home purchase.

The reality is, questions are expected. You hired your inspector for their professional expertise, so don’t be shy about tapping into it. For example, you might ask:

- Would you get this issue fixed in your own home?

- How urgent is it?

- What could happen if I don’t fix it?

- Is this a simple issue I could fix myself?

- What type of professional should I call?

- Can you estimate how much it would cost to make this repair?

- How much longer would you expect this system/structure/appliance to last?

- What maintenance steps would you recommend?

Don’t bother asking your inspector if you should buy the property, because he/she won’t be able to answer that question for you. Instead, use the information provided to make an informed decision. A skilled real estate agent can help you determine the best path.

MISTAKE 6: Expect a Perfect Report

Some buyers get scared off by a lengthy inspection report. But with around 1600 items on an inspector’s checklist, you shouldn’t be surprised if yours uncover a large number of deficiencies.4 The key is to understand which problems require simple fixes, and which ones will require extensive (and costly) repairs.

Your real estate agent can help you decide if and how to approach the sellers about making repairs or reducing the price. Whatever you do, try to focus on the major issues identified in the inspector’s report, and don’t expect the sellers to address every minor item on the list. They will be more receptive if they perceive your requests to be reasonable.

MISTAKE 7: Forgo Additional Testing

There are times when an agent or inspector will recommend bringing in a specialist to evaluate a potential issue.5 For example, they may suggest testing for mold or consulting with a roofing expert.

Some buyers get spooked by the possibility of a “red flag” and decide to jump ship. Or, in their haste to close or desire to save money, they choose to ignore the recommendation for additional testing altogether.

Don’t make these potentially costly mistakes. In some cases, the specialist will offer a free evaluation that takes minimal time to schedule. And if not, the small investment you make could provide you with peace of mind or save you a fortune in future repairs.

MISTAKE 8: Skip Re-inspection of Repairs

Most buyers request receipts to prove that repairs have been correctly completed. However, it’s always prudent to go a step further and have negotiated repairs re-evaluated by your inspector or another qualified professional, even if there’s an additional charge.6

While the majority of sellers are forthcoming, some will try to save money by cutting corners, hiring unlicensed technicians, or doing the work themselves. A re-inspection will help ensure the repairs are completed properly now, so you aren’t paying to redo them later.

To avoid having to go back to the sellers, be specific when requesting repairs. Identify the problem, how repairs should be completed, who should complete the work, and how the repairs will be verified.7

Some buyers prefer to avoid this step altogether by completing the work themselves. They either request that the seller fund the repairs or reduce the selling price accordingly. Whichever path you choose, protect yourself and your investment by ensuring the work is done properly.

WE CAN HELP

A home inspection can reduce your risk and save you money over the long-term. But to maximize its effectiveness, it must be done properly. Avoid these eight common home inspection mistakes to safeguard your investment.

While these are some of the most common missteps, there are countless others that can trip up home buyers, cost them time and money, and cause undue stress. Fortunately, we have the skills and experience to help you avoid the potential pitfalls.

If you’re in the market to buy a home in the Boulder metro area, we can help you navigate the inspection and all the other steps in the buying process … typically at no cost to you! Tap into our expertise to make the right decisions for your real estate purchase. Contact us today to schedule a free consultation!

———————–

Sources:

- Family Handyman –

https://www.familyhandyman.com/tools/diy-home-inspection-tools/view-all/

- HGTV –

https://www.hgtv.com/design/real-estate/finding-the-right-home-inspector

- The New York Times –

https://www.nytimes.com/2018/03/23/realestate/home-inspection.html

- Realtor.com –

https://www.realtor.com/advice/buy/what-does-a-home-inspector-look-for/

- Realty Times –

https://realtytimes.com/advicefromagents/item/37369-top-5-biggest-home-inspection-mistakes

- Realtor.com –

https://www.realtor.com/advice/buy/home-inspection-mistakes-buyers-should-avoid/

- Star Tribune –

http://www.startribune.com/who-verifies-repairs-after-the-home-inspection/132844523/

SaveSave

SaveSave

SaveSave

by Farley Webmaster | Jun 13, 2018

Whatever your reasons are for relocating to a new area, the process can feel overwhelming.

Whether you’re moving across across town or across the country, you’ll be changing more than your address. Besides a new house, you may also be searching for new jobs, schools, doctors, restaurants, stores, service providers and more.

Of course you’ll need to pack, make moving arrangements, and possibly sell your old home. With so much to do, you may be wondering: Where do I start?

In this guide, we outline seven steps to help you get prepared, get organized, and get settled in your new community. Our hope is to alleviate the hassle of relocating—so you can focus on the exciting adventure ahead!

1. Gather Information

If you’re unfamiliar with your new area, start by doing some research.1 Look for data on average housing prices, demographics, school rankings and crime statistics. Search for maps that illustrate local geography, landmarks, public transportation routes and major interstates. If you’re moving across the country, research climate and seasonal weather patterns.

Check out local newspapers and blogs for information on political issues and developments that could impact your new community. You may also want to search for online forums and Facebook Groups relevant to your new area. These can be a great place to find information, ask questions and just observe local attitudes and outlooks.

If you’re relocating for a job, find out if your new employer offers any relocation assistance. Many large corporations have a designated human resources professional to assist employees with relocation efforts, while others may contract this service out to a third party. Some employers will also cover all or a portion of your relocation and moving costs.

By gathering this information up front, you’ll be better prepared to make informed decisions down the road.

| Let us know if you’d like assistance with your information gathering process. We have a wealth of knowledge about this area, and we keep a number of reports and statistics on file. We would be happy to share information and answer any questions you may have. |

2. Identify Your Ideal Neighborhoods

Once you’ve sufficiently researched your new area, you can start to identify your ideal neighborhoods.

The first step is to prioritize your “needs” and “wants.” Consider factors such as budget; commute time; quality of schools; crime rate; walkability; access to public transportation; proximity to restaurants, shopping, and place of worship; and neighborhood vibe.

If possible, visit the area in person to get a feel for the community. If you’re comfortable, strike up conversations with local residents and ask about their experiences living in the area.

Still not sure which neighborhood is the best fit for you and your family? Contact a local real estate agent for expert assistance. It’s usually the most efficient and effective way to narrow down your options.

| We provide neighborhood assessments and advice as a free service if you’re relocating to Boulder, Colorado or near by areas. Or, if you’re moving out of town, we can refer you to a local agent who can help. |

Charming Bungalow 1/2 Mile to Pearl Street 646 Marine Street, Boulder, 80302

3. Find Your New Home (and Sell Your Old One)

Once you’ve narrowed down your list of preferred neighborhoods, it’s time to start looking for a home. If you haven’t already contacted a real estate agent, now is the time. They can search for current property listings that meet your needs, typically at no cost to you.

Create another list of “needs” and “wants,” but this time for your new home. Include your basic requirements for square footage, bedrooms and bathrooms, but also think about what other factors are important to you and your family. An updated kitchen? A large backyard? Double sinks in the master bathroom?

Narrow your list down to your top 10 and prioritize them in order of importance.2 This will give you a good starting point to begin your home search. Unless you have an unlimited budget, don’t expect to find a home with everything on your list. But having a prioritized list can help you (and your agent) understand which home features are the most important, and which ones you may be willing to sacrifice.

If you already own a home, you’ll also need to start the process of selling it or renting it out. A real estate agent can help you evaluate your options based on current market conditions. He or she can also give you an idea of how much equity you have in your current home so you know how much you can afford to spend on your new one.

Your agent can also advise you on how to time your sale and purchase. While some buyers are able to qualify for and cover the costs of two concurrent mortgages, many are not. There are a number of options available, and a skilled agent can help you determine the best course given your circumstances.

| We would love to assist you if you have plans to buy or sell a home in Boulder, Colorado. Please contact us to schedule a free consultation so we can discuss your unique needs and devise a custom plan to make your relocation as seamless as possible. If you’re relocating outside of Colorado, we can help you find a trusted agent in your new city. |

4. Prepare for Your Departure

While everyone considers packing a fundamental part of moving, we often overlook the emotional preparation that needs to take place. If you have children, this can be especially important. Communicate the move in an age-appropriate way, and if possible take them on a tour of your new home and neighborhood. This can alleviate some of the mystery and apprehension around the move.4

Allow yourself plenty of time to pack up your belongings. Before you start, gather supplies, including boxes, tape, tissue paper and bubble wrap. Begin with non-essentials—such as off-season clothes or holiday decorations—and sort items into four categories: take, trash, sell and donate/give away.5

To make the unpacking process easier, be sure to label the top and sides of boxes with helpful information, including contents, room, and any special instructions. Keep a master inventory list so you can refer back to it if something goes missing.

If you will be using a moving company, start researching and pricing your options. To ensure an accurate estimate of your final cost, it’s best to have them conduct an in-person walkthrough. Make sure you’re working with a reputable company, and avoid paying a large deposit before your belongings are delivered.6

If you plan to drive to your new home, map out the route. And, if necessary, make arrangements for overnight accommodations along the way. If driving is not a good option, you may need to have your vehicles transported and make travel arrangements for you, your family and your pets.

Lastly, if you will be leaving friends or family behind, schedule final get-togethers before your departure. The last days before moving can be incredibly hectic, so make sure you block off some time in advance for proper goodbyes.

| Looking for a reputable moving company? We are happy to provide referrals, as well as recommendations on where to procure packing supplies in our area. |

Learn more about the neighborhoods that make up Boulder, Colorado

5. Prepare for Your Arrival

To make your transition go smoothly, prepare for your arrival well before moving day. Depending on how long your belongings will take to arrive, you may need to arrange for temporary hotel accommodations. If you plan to move in directly, pack an “essentials box” with everything you’ll need for the first couple of nights in your new home, such as toiletries, toilet paper, towels, linens, pajamas, cell phone chargers, snacks, pet food and a change of clothes.7 This will keep you from searching through boxes after an exhausting day of moving.

Arrange in advance for your utilities to be turned on, especially essentials like water, electricity and gas. (And while you’re at it, schedule a shut-off date for your current utilities.) Update your address on all accounts and subscriptions and arrange to have your mail forwarded through the postal service. If you have children, register them for their new school or daycare and arrange for the transfer of any necessary records.

You may want to have the house professionally cleaned before moving in. And if you plan to remodel, paint or install new flooring, it’s easier to have it done before you bring in all of your belongings.8 However, it’s not always feasible without someone you trust locally who can supervise. Another option is to keep a portion of your things in storage while you complete some of these projects.

If there are no window treatments, you may need to install some (or at least put up temporary privacy film), especially in bedrooms and bathrooms. And if appliances are missing, consider purchasing them ahead of time and arranging for delivery and installation shortly after you arrive. Just be sure to check measurements and installation instructions carefully so you aren’t stuck with an appliance that doesn’t fit or that requires costly modifications to your new home.

If you own a car, check the requirements for a driver’s license and vehicle registration in your new area and contact your insurance company to update your policy.8 If you will rely on public transportation, research options and schedules.

| If you’re relocating to Boulder, we can help! We offer “VIP Relocation Assistance” to all of our buyer clients. Contact us for a list of preferred hotels, utility providers, housekeepers, contractors and more! |

6. Get Settled In Your New Home

While staring at an endless pile of boxes can feel daunting, you should take advantage of this opportunity to make a fresh start. By creating a plan ahead of time, you can ensure your new house is thoughtfully laid out and well organized.

If you followed our suggestion to pack an “essentials box” (see Step 5), you should have easy access to everything you’ll need to get you through the first couple of nights in your new home. This will allow you some breathing room to unpack your remaining items in a deliberate manner, instead of rushing through the process.7

If you have young children, consider unpacking their rooms first. Seeing their familiar items can help them establish a sense of comfort and normalcy during a confusing time. Then move on to any items you use on a daily basis.10

Pets can also get overwhelmed by a new, unfamiliar space. Let them adjust to a single room first, which should include their favorite toys, treats, food and water bowl, and a litter box for cats. Once they seem comfortable, you can gradually introduce them to other rooms in the home.11

As you unpack, make a list of items that need to be purchased so you’re not making multiple trips to the store. Also, start a list of needed repairs and installations. If you have a home warranty, find out what’s covered and the process for filing a service order.

Although you may be eager to get everything unpacked, it’s important to take occasional breaks. Have some fun, relax and explore your new hometown!

| Need help with unpacking, organizing or decorating your new home? Contact us for a list of recommended professionals in Boulder. And when you’re ready to start exploring local “hot spots,” we’d love to fill you in on our favorite restaurants, stores, parks and other attractions! |

Get an insider’s guide to Boulder

7. Get Involved In Your New Community

Studies show that moving can lead to feelings of loneliness and depression. People who have recently moved tend to be isolated socially, more stressed, and less likely to participate in exercise and hobbies. However, there are ways to combat these negative effects.12

First, get out and explore. In a 2016 study, recent movers were shown to spend less time on physical activities and more time on their computers, which has been proven to lead to feelings of depression and loneliness. Instead, get out of your house and investigate your new area. And if you travel by foot, you’ll gain the advantages of fresh air and exercise.12

Combat feelings of isolation by making an effort to meet people in your new community. Find a local interest group, take a class, join a place of worship or volunteer for a cause. Don’t wait for friends to come knocking on your door. Instead, go out and find them.

Finally, be a good neighbor. Make an effort to introduce yourself to your new neighbors, invite them over for coffee or dinner, and offer assistance when they need it. Once you’ve developed friendships and a support system within your new neighborhood, it will truly start to feel like home.

| Want more ideas on how to get involved in your community? Contact us for a free copy of our report, “Welcome Home: 10 Tips to Turn Your Neighborhood Into a Hometown Haven.” |

LET’S GET MOVING

While moving is never easy, these seven steps offer an action plan to get you started on your new adventure. To avoid getting overwhelmed, focus on one step at a time. And don’t hesitate to ask for help!

In a 2015 study, 61 percent of participants ranked moving at the top of their stress list, above divorce and starting a new job.13 But with a little preparation—and the right team of professionals to assist you—it is possible to have a positive relocation experience.

We specialize in assisting home buyers and sellers with a seamless and “less-stress” relocation. Along with our referral network of movers, handymen, housekeepers, decorators, contractors and other service providers, we can help take the hassle and headache out of your upcoming move. Give us a call or message us to schedule a free, no-obligation consultation!

_______________________________________________________________________________

Sources:

- You Move Me –

https://www.youmoveme.com/us/blog/105-tips-for-a-successful-relocation

- com –

https://www.houselogic.com/buy/house-hunting/must-have-items/

- Livestrong –

https://www.livestrong.com/article/436651-the-effects-of-sunlight-fresh-air-on-the-body/

- Parents Magazine –

https://www.parents.com/parenting/money/buy-a-house/make-moving-easier-on-you-and-your-kids/

- The Spruce –

https://www.thespruce.com/starting-to-pack-for-your-move-2436470

- com –

https://www.moving.com/tips/hiring-quality-movers/

- The Spruce –

https://www.thespruce.com/unpack-your-entire-home-2435815

- com –

https://www.houselogic.com/buy/moving-in/before-you-move/

- HGTV –

https://www.hgtv.com/design/real-estate/moving-checklist

- com –

https://www.moving.com/tips/how-to-unpack-and-organize-your-house/

- ASPCA –

https://www.aspca.org/pet-care/general-pet-care/moving-your-pet

- Psychology Today –

https://www.psychologytoday.com/us/blog/is-where-you-belong/201607/why-youre-miserable-after-move

- The Daily Express –

https://www.express.co.uk/news/uk/574171/Divorce-stressful-moving-home

SaveSave

SaveSave

by Farley Webmaster | May 8, 2018

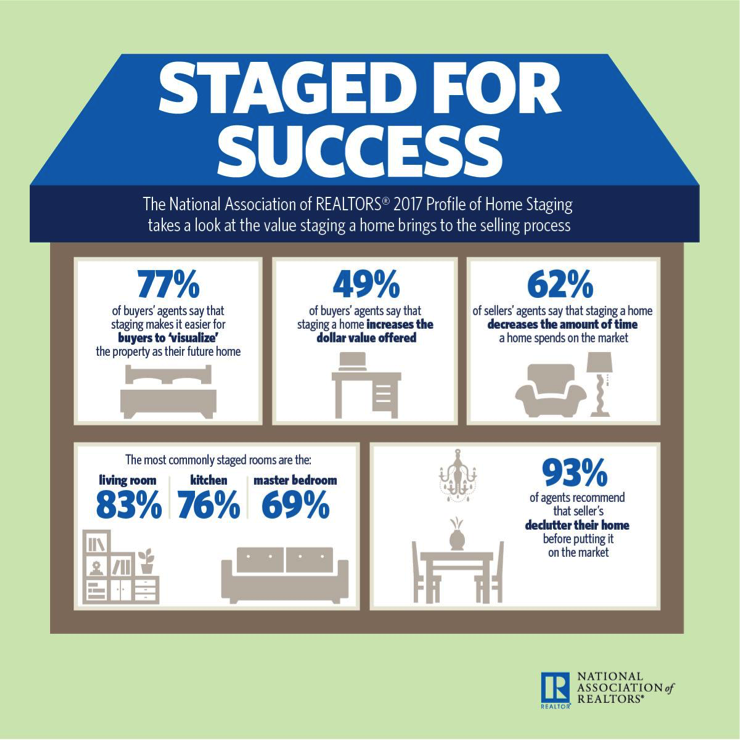

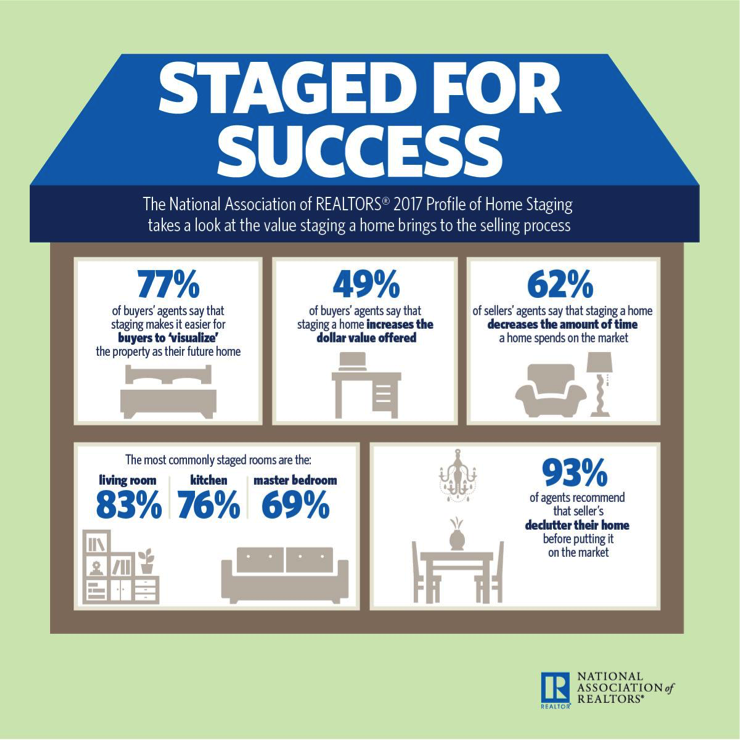

According to the National Association of Realtors, staging a home prior to listing it can result in a faster and more profitable sale.1 In fact, the Real Estate Staging Association estimates that professionally staged properties spend 73 percent less time on the market, receive more foot traffic, and typically sell for more money.2

Following are 10 tips you can use to get your home “show ready” prior to hitting the market. These easy and cost-effective ideas will help your house look its best—and help buyers visualize themselves living there. Even if you’re not currently in the market to sell, you can use these tactics to breathe new life into your existing home decor.

To get a plan customized for your particular property, give us a call to schedule a free consultation. We’d be happy to share our insider knowledge of the buyer preferences in your neighborhood … so you’ll know where to focus your time, money and energy to maximize your results.

1. REMOVE CLUTTER

Decluttering is typically the first thing we tell clients to do to prepare their home for sale. And according to the National Association of Realtors, a whopping 93 percent of agents agree.1Decluttering is the act of removing excess “stuff” from your home to make it appear clean and spacious.

Overflowing closets and cluttered countertops can make your house feel small and cramped. In contrast, sparsely-filled closets and clear countertops will make your home appear larger and assure buyers that there will be plenty of room to store their belongings.

Don’t neglect drawers, cupboards and even your refrigerator in your decluttering efforts. Serious buyers will check out every nook and cranny of your home, so pack up anything you don’t use on a daily basis and store it off site. The same goes for jewelry, sensitive documents, prescription medication, firearms and other items of value. Store them in a locked safe or storage unit before opening your property to buyers.

Make sure any items that remain are clean, tidy and well organized. The good news is, when it comes time to move, a large portion of your packing will be done!

2. DEEP CLEAN AND DEODORIZE

From carpets to bathrooms to appliances, having a clean home is a MUST. If you’ve ever checked into a dirty hotel room, you can imagine how buyers can be turned off by a home that hasn’t been thoroughly cleaned.

If you have a large home, or are short on time, you may want to invest in a professional cleaning service. And if you have carpet, we generally recommend you rent a steam cleaner or hire a company to clean your carpets for you.

In addition to cleaning, it’s equally important to neutralize odors in your home that can be off-putting to buyers, especially pet smells and cigarette smoke. If the weather allows, open your windows and let in fresh air. Empty the trash frequently, and especially before a showing. Avoid cooking any strong-smelling food such as fish or heavy spices. You may need to clean (or remove) drapes and upholstery if odors are particularly strong.

Try to keep your home in clean, show-ready condition while it’s on the market. You never know when a potential buyer will want to drop by for a viewing.

3. DEPERSONALIZE

Your family photos and personal mementos are often your most treasured possessions. For many of us, they are what make a house a home. However, buyers will have a hard time envisioning themselves living in a place if it feels like YOUR home.

Pack up any items that are personal to you and your family, such as photos, books, children’s artwork, travel souvenirs and religious items. Collectibles and excessive knickknacks can be distracting to buyers. Instead, keep your decor items minimal and generic to appeal to the largest number of buyers.

4. NEUTRALIZE YOUR COLOR PALETTE

Along those same lines, bold color choices may not appeal to all buyers. By incorporating a neutral color palette throughout your home, buyers can better visualize the addition of their own furniture and decor, which may contrast with your current color scheme.

But don’t limit yourself to white and beige. Incorporating earth tones and midtone neutrals—like mocha and “greige” (grey-beige)—can add a touch of modern sophistication to your decor.3

One of the quickest and most cost-effective ways to neutralize your home’s decor is with paint. Walls painted in dark, bold or bright colors can turn off buyers. A fresh coat of paint in a neutral color like greige (try Benjamin Moore’s Revere Pewter) or warm white (such as Kelly-Moore’s Rotunda White) offers a clean palette upon which buyers can visualize adding their own personal touches.4

If your sofa is worn, stained or has a bold pattern, consider purchasing a neutral-colored slipcover. Dated or overly busy window coverings should be taken down or replaced. Instead, bring in tasteful pops of color with throw pillows and accessories.

5. INCREASE YOUR CURB APPEAL

You only get one chance to make a first impression. According to a 2017 report by the National Association of Realtors, 44 percent of home buyers drove by a property after viewing it online but did NOT go inside for a walkthrough.5That means if your curb appeal is lacking, buyers may never make it through the door.

Walk around your home and look for any neglected areas that might seem like “red flags” to buyers, such as missing roof shingles or rotted siding. Trim trees and shrubs if needed, and make sure your lawn and flower beds are well maintained. Add some colorful flowers to your front beds and/or flower boxes to brighten up your landscaping.

Make sure the exterior of your home is as clean as the interior. This can often be accomplished with a simple garden hose. But if your siding, walkway, or driveway are stained or dingy, you may want to rent a pressure washer.

Thoroughly wash windows and screens, and remove and store dark solar screens if you have them. Open shutters, curtains and blinds, which will not only make your house look more inviting from the outside, it will brighten the inside.

Consider a fresh coat of paint on your front door, trim and shutters. And small, cosmetic improvements like new house numbers, a colorful wreath and a clean front doormat can have a big impact.6

6. FRESHEN KITCHENS AND BATHS

Kitchens and bathrooms will show better and appear larger if all items are cleared from the countertops, except for one or two decorative pieces.7You should have already packed up non-essentials during your decluttering process, and the remaining items should be neatly stored in pantries and cupboards.

If your cabinets are dingy or outdated, adding a fresh coat of paint and new hardware is an easy and inexpensive way to make them modern and bright. Consider purchasing new shower curtains, bath mats and towels for the bathrooms and new dish towels for the kitchen.

Before each showing, make sure kitchens and baths are spotless and trash cans are empty and out of sight. To add a comforting aroma, try baking cookies, or in the fall, simmer some cinnamon sticks and cloves in a pot of water before you leave the house. In the spring, try a vase of fresh cut lilacs.7

7. SET THE TABLE

Buyers often imagine hosting family gatherings in their new home, and the dining room plays a large role in that vision. If your dining room chairs are stained or outdated, you may want to recover them or use slipcovers. In most cases, an imperfect table can be camouflaged with a neutral and stylish tablecloth.

Be sure the table is centered underneath the chandelier and on the area rug if you’re using one. If your dining room is small, remove all other furniture and leave only four chairs.8

Dress up the table using nice tableware and cloth napkins or a table runner and centerpiece. For a long table, try lining up a series of small vessels down the middle.

8. REARRANGE FURNITURE

Start in your living room and think about what you want to emphasize (and de-emphasize) about the space. For example, do you have a beautiful fireplace or a stunning view? If so, arrange the furniture with that focal point in mind. Use a symmetrical seating arrangement to create a cozy conversation area adjacent to the focal point.

If the room is small, consider removing some of the furniture to make it feel larger, especially oversized pieces. That includes oversized television sets, unless it’s a designated media room. Pulling furniture away from the wall can make the room feel more spacious, and placing your largest furniture piece in the far-left corner (as opposed to near the entry) can create the illusion of a larger space.9

For small bedrooms, remove all the furniture except the bed, bedside tables and a dresser. If it’s a large room, add one or two chairs and a table to create a seating area. Place lamps on the bedside tables and seating area if you have one.10

Make sure each space in your home has a clearly defined purpose. For example, if you’ve been using an extra bedroom as a catch-all storage space, stage it as a guest room or office instead. Turn an awkward alcove into a workstation or a reading corner. Help buyers imagine how they could use the space themselves.3

9. LIGHTEN UP

Lighting can have a drastic impact on the look and feel of a home. Few buyers seek out a dark house; most prefer one that’s light and bright. Make sure windows are clean, and open curtains and blinds to let in the maximum amount of daylight.

Each room should have three types of lighting: ambient (general or overhead), task (such as a reading lamp or under-cabinet light), and accent (such as a floor or table lamp). Aim for a goal of 100 total watts per 50 square feet.11If your mounted light fixtures are dated, replacing them with something more modern is an easy and inexpensive upgrade that can have a big impact.

Strategically placed landscape lighting can add a dramatic effect to your home’s exterior. Welcome evening visitors with a lighted walkway, or use a spotlight to accentuate trees or other landscaping features. Solar lights require no wiring; simply place them in a sunny spot and they will turn on automatically at dusk.

10. HIGHLIGHT YOUR BACKYARD’S BEST FEATURES

While your home’s interior often takes center stage, don’t forget about staging your home’s outdoor areas to help buyers imagine how they could utilize the space.

Even a small patio can become a selling feature with the addition of a cafe table and chairs. Add a tray of plates and coffee cups to help buyers envision a peaceful breakfast on the back porch. Place chairs and wine glasses around an outdoor firepit or hang a hammock with a book in your favorite shady spot.3 These small, simple additions can help buyers visualize the possibilities your backyard has to offer.

BEFORE YOU GET STARTED

If you’re in the market to sell your home, this list provides a great starting point for your preparations. But nothing beats the trained eye and expertise of a real estate agent. Before you do any work, we recommend consulting a professional for advice about your particular property.

We offer free, no-commitment seller consultations and will walk through your home with you to help you assess which projects and upgrades are worth your time and money, and which ones you can skip.

As Boulder market experts, we are intimately familiar with buyer preferences in our area . We’ll run a comparative market analysis to find out how your home compares to others currently on the market, as well as those that have recently sold. Then we’ll tailor a custom plan to suit your particular property, budget and needs. Even in a hot market like Boulder or the Denver Metro area, details are important to ensure you sell your home quickly and for the best price.

Please call us today at 303-475-6269 with questions or to schedule a free consultation!

SaveSaveSaveSave

______________________________________________

Sources:

- National Association of Realtors –

https://www.nar.realtor/sites/default/files/migration_files/reports/2017/2017-profile-of-home-staging-07-06-2017.pdf

- Real Estate Staging Association –

http://www.realestatestagingassociation.com/content.aspx?page_id=22&club_id=304550&module_id=164548

- Houzz –

https://www.houzz.com/ideabooks/2661221/list/sell-your-home-fast-21-staging-tips

- HGTV –

https://www.hgtv.com/design/outdoor-design/landscaping-and-hardscaping/10-curb-appeal-tips-from-the-pros-pictures

- National Association of Realtors –

https://www.nar.realtor/sites/default/files/reports/2017/2017-home-buyer-and-seller-generational-trends-03-07-2017.pdf

- The Spruce –

https://www.thespruce.com/must-try-neutral-paint-colors-797983

- HouseLogic –

https://www.houselogic.com/sell/preparing-your-home-to-sell/home-staging-checklist/

- com –

http://www.stagemyownhome.com/staging-the-dining-room.html

- com –

https://www.realtor.com/advice/sell/small-living-room-staging-tricks/

- SFGATE –

http://homeguides.sfgate.com/stage-master-bedroom-34573.html

- HGTV –

https://www.hgtv.com/shows/designed-to-sell/15-secrets-of-home-staging-pictures

SaveSave

SaveSave

SaveSave